Initially conceptualized from a voter’s perspective looking to improve capital efficiency for governance token holders, gauges incentives were designed with a profit maximalist vision and allowed small cap project which often owns large POL shares to swap their native liquidity mining for a stronger currency at a discount while edging against selling pressure by incentivizing LPs in their native pools.

This was essentially made possible by liquid lockers’ flywheel taking advantage of the boost calculation formula to allow pool’s major shareholders (like in “project’s POL”) to remain eligible for 1.8x to 2.2x boost on the base yield layer as well as additional emissions issued by the liquid wrapper, again benefiting from the high lock rate to compound this second yield layer.

Amidst the numerous opportunities for market participants to bootstrap their treasury and network effect, one consequence of the rapid development of voting incentives markets (or Governance wars) is that at some point the governance framework lost its original purposes to serve the underlying platform’s (Curve at this time) fees and volume objectives.

Later on, Balancer came in with an innovative approach by implementing the core pools program capping gauge voting shares to 2% and 10% for a selected list of pools according to their revenue generation KPI

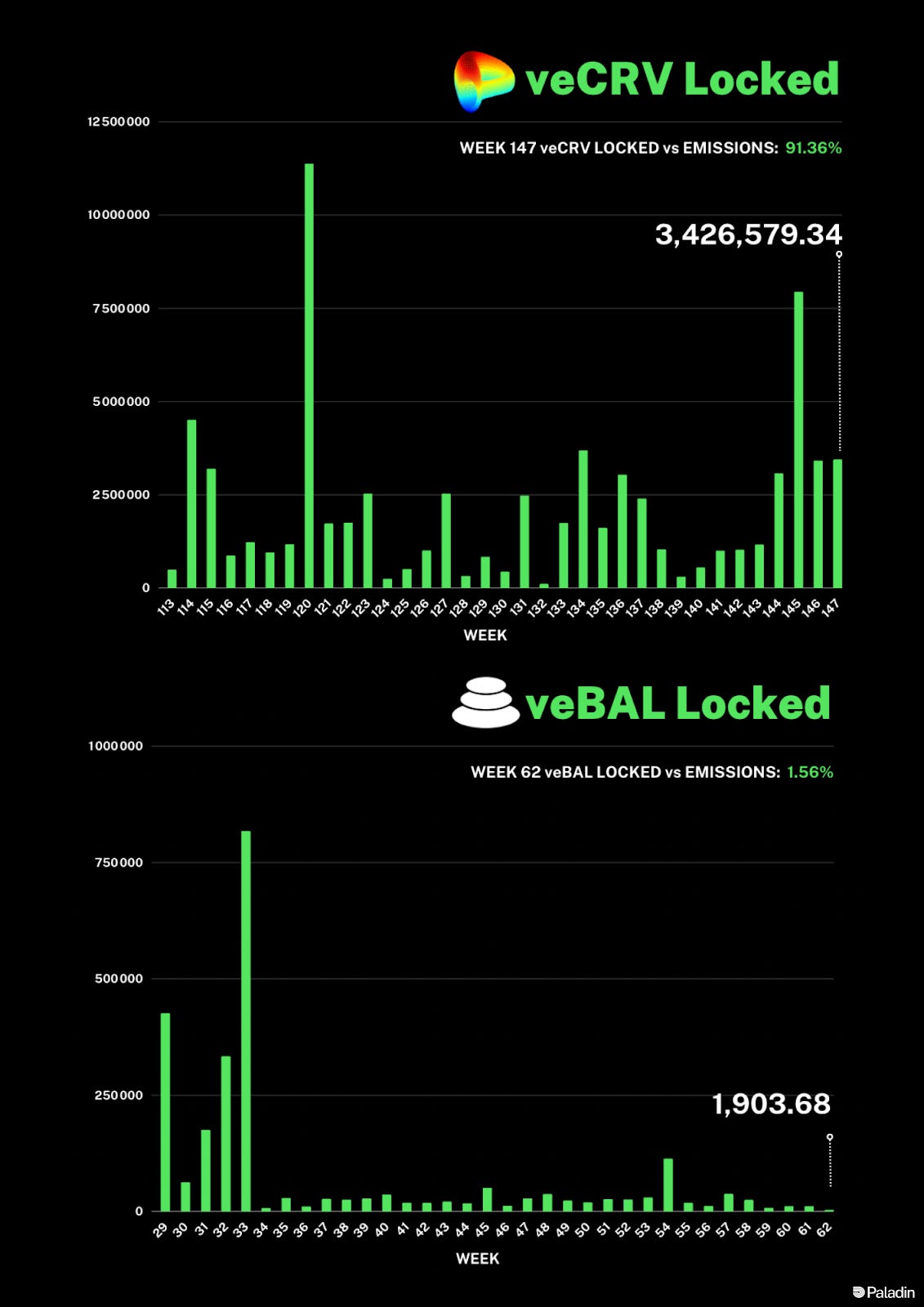

Since the quantity of token issued decreases overtime according to an emission drop schedule, and considering user’s compounding of BAL or CRV rewards into more governance power, the $ value of emissions captured per vote is inversely proportional to the evolution of governance token supplies.

Considering the relative loyalty of voters to specific pools, as well as the relative consistency of voting incentives volumes, one should ask himself how much governance power is available to capture before entering the battlefield.

This chart indicates that veBAL voters used to be much more committed to a specific set of pools in the past, and started to increasingly spread their voting power among a wider set of pools recently, even though the total voting power seem to decrease which as we’ve seen tends to increase the quantity of emissions controlled per votes, thus the intrinsic price of the vote.

Then, it is possible to describe the problem as how to tell when it's more efficient to offer gauge rewards through fixed or variable rate gauges incentives ?

1) Forecasting incentives efficiency

In a previous series on vote incentives pricing, we have introduced the economic principles at play within the governance wars, identified several variables that are responsible for the correlation between the volume and value of incentives, and demonstrated the efficiency of probabilistic models to anticipate the future $/votes ratio.

You can find more details in Weekly Gauge 41 ; 42 ; and 43.

During its first year of existence, thanks to a favorable market narrative and the low dilution of emissions, efficiency in the vlAURA market was high, in excess of 1.5 to 2x. Yet over recent voting cycles, efficiency for incentives has begun to compress toward 1x, resulting in attempts from incentives creators to maintain efficiency by searching for optimization.

This example is highlighted in a recent proposal on Aura DAO that seeks to integrate a set of variables representing market conditions to narrow the risk of overpaying votes and navigate between different gauges incentive models.

A category of key actors of governance wars called delegation addresses (vote market makers) emerged in late 2022, originally designed to simplify voter’s experience, it quickly grew up adding new features like unionizing or auto compounding rewards to counter the negative effects of gas prices and help onboarding retail users and wider adoption.

However, first movers benefited from a massive network effect and market fit that pushed the offer to reach the scaling limits of vote aggregation (flatten price, reduced flexibility, driven by voters performance instead of token issuers’).

Although it is becoming easier to anticipate with a small margin of error the future price range of incentives, thanks to the large dominance of delegation addresses and given the low variation of bootstrapped gauges count according to total volume per round, the variety of impactful vectors on the efficiency of variable rate incentives remains a great barrier to optimization.

2) Quest v1

Quest was built by Paladin with the idea that faced with a situation where there are numerous variables and it is challenging to calculate interest rates precisely, you can employ a combination of products and services to simplify market interactions and create a more sustainable environment.

For creators :

Analyze the fundamental factors of influence and identify the most critical variables,

Study historical data and patterns of interest rate movements,

Stay informed about expert opinions or research from reputable sources, and continuously monitor changes in relevant factors.

Create value creating flywheel with your native token liquidity mining

For voters :

Earn predictable APR

Set and Forget your vote allocation

Activate the efficiency of the delegation address to consolidate rewards under a single stable currency

Access every layers of vote incentives on multiple chains

In other words, order book based or fixed-rate marketplaces, such as Paladin Quest, allows buyers and sellers to meet at a desired price, encouraging coordination and ev+ situation for each participant. Nevertheless, this design has demonstrated its limits to some extent and in specific market conditions.

To remain efficient and capable of evolving as a building block for decentralized governance and thriving to improve its market fit, Paladin is built by iteration and constantly learning from its environment, all of which led to the conception of Quest v2.

In conclusion, this weekly gauge highlights the evolving landscape of voting incentives markets and the challenges they present for decentralized governance. As governance frameworks deviate from their original intentions, the efficiency of gauge rewards through fixed or variable rate incentives becomes a key consideration.

Delegation addresses have emerged as influential players, simplifying the voting process but also introducing complexities. Paladin's Quest offers a solution by simplifying market interactions, yet further improvements brought by Quest v2 will help to better adapt to market conditions.

Overall, we highlighted the importance of optimizing incentives models and finding sustainable approaches for decentralized governance to thrive in a rapidly changing environment.