In a bit less than two years, the Curve/Convex ecosystem gathered 248,450,000$ in voting incentives, adding to it the various other veCRV wrappers, boost marketplaces and the Balancer voting market - whose total incentives reached 7,345,371$-, it represents a fast-growing and insanely liquid opportunity to earn passive income with high APRs compared to tradFi.

While the everlasting ZK rollup narrative is clearly underlying support to the adoption of L2s, we can observe several factors that indicate the governance wars already began on various ecosystems and might bring enough liquidity to make them too big to fail against no ZK.

Before diving further into numerical data and statistics around L2 expansion, let’s introduce various projects that are all pioneers in their ecosystems and contribute strongly to the bootstrap of L2 liquidity.

Tetu is the first liquid locker operating a governance proxy on a sidechain (Polygon) dedicated to a layer 1 native protocol (Balancer). We’ve previously introduced the project’s tokenomics in Weekly Gauge #28 as well as the bootstrap of their liquidity settled by the Humpy treaty. Currently, veTetu gets you about 3x as much voting power for the same cost, as compared to just buying veBal.

Even though it suffered from the Gabagool drama in early Q4, VelodromeFi is making an impressive come-back and keeps its position of main catalyst for the liquidity wars on Optimism rollup. The protocol is similar to Curve in its vetokenomics, except that holders’ shares of trading fees come only from the gauge they voted for, which is designed to incentivize volume instead of passive liquidity,

Fantom Bomb is a deflationary multichain farming project, where the DAO treasury stacks governance tokens on multiple chains, and uses voting incentives to start multiple flywheels. The end goal is to drive value to holders by burning as much $fBOMB as possible, reducing supply, and give great farming APRs.

The 3xcalibur ecosystem is a DeFi hub built on Arbitrum. They claim to be a “permissionless, liquidationless, oracleless liquidity marketplace, powered by Tri-AMM architecture to facilitate stableswaps, variable swaps and borrowing/lending”. 3xcali-Govern feature uses vote escrowed (ve) tokenomics for their token $XCAL. $veXCAL can be used to vote and direct emissions. Since the inception of its governance market, the protocol has gathered 237,757$ of incentives.

Data Analysis :

Considering the last 2 quarters, we can observe that Arbitrum and Optimism are leading ecosystems in terms of growth with around 100% of TVL increase. Meanwhile, Polygon and Fantom are showing a small decrease, Polygon being the most volatile ecosystem on these metrics.

Curve’s greatest upward trend in TVL on L2 is Optimism

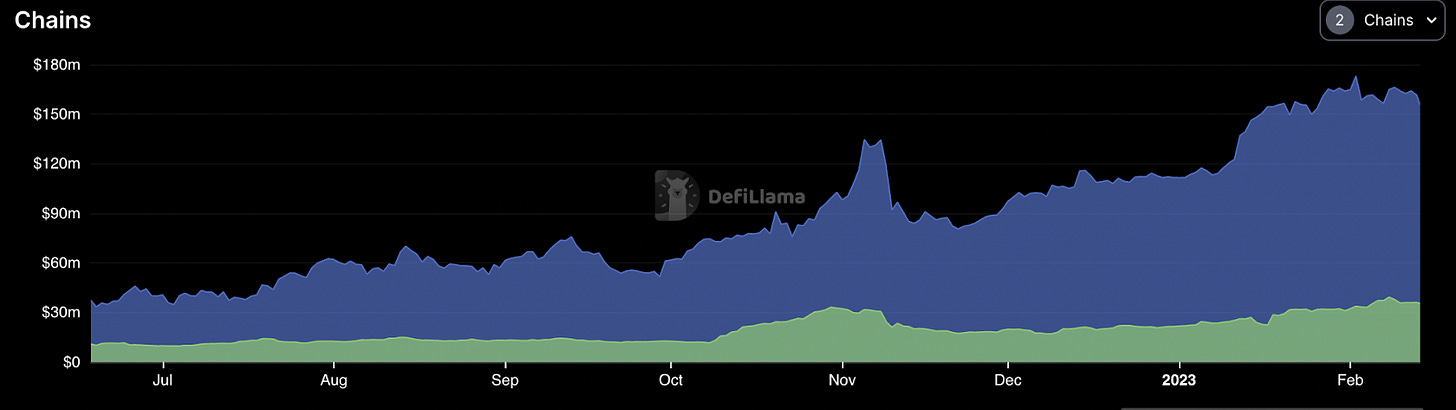

The TVL increase on Optimism is mostly driven by the development of VelodromeFi, this is also what carries the governance wars on the rollup. Since July 2022, veVELO voters have been incentivized a total of 6,461,418$.

https://dune.com/0xkhmer/velodrome-historical-voting-apr

Balancer has developed a lot on Polygon and Arbitrum over the past few months, both chains experienced a 400% increase in TVL, respectively from 40M$ (P) and 9M$ (A) to 160M$ and 36M$.

In order to further iterate on top of the DAO model for decentralized projects, the hybrid L2 Metis has partnered with Koris to technically enable the creation of Decentralized Autonomous Companies (DACs) which allows for more features like managing tasks, membership, voting, and treasury in one place.

As the Ethereum network becomes increasingly congested and expensive to use, we are seeing a growing demand for more scalable and cost-effective alternatives. The data we have analyzed supports the L2s bullish outlook, whose Total Value Locked (TVL) has experienced significant growth in recent months, and we expect this trend to continue as more users and projects migrate to these networks.

Actually, we have observed a strong network effect at play, as governance becomes an increasingly important aspect of the DeFi ecosystem, layer 2 solutions offer an attractive environment for governance tokens, allowing for more efficient participation in decision-making processes.