Tetu is a yield management platform that is built and designed in a way to provide easy access for new contributors and users. The Tetu protocol is governed by veTetu (formerly dxTetu), an 80Tetu-20USDC Curve-style locked LP token.

In a previous twitter thread about vote delegation, we hinted that the rise of Tetu would be a key catalyst for the narrative of governance-controlled emission farming on side chains and layer 2. In this article, we'll reiterate by introducing the veTetu framework as a promising primitive allowing the project to iterate on multiple designs until sustainability is reached.

When some major participants of this economy such as Lido migrate their mainnet incentives program to enhance L2s liquidity, and considering the growing number of multichain projects implementing ve-governed designs, we can expect more development on Polygon that will ultimately benefit veTetu holders.

Without further ado, let’s dive in.

Tetu as a locker :

Since it launched in 2022, the TetuBal wrapper attracted 512,131 veBAL or 4.5% of the current supply. Considering the upcoming decrease in BAL inflation rate, the future $emission/veBAL should be near 0.0715$, which will make the project direct 36.5k$ of emissions per week. This will increase as both Humpy and Balancer “shareholders” are going to unlock their veBAL over the coming months.

The Tetu/USDC pool currently accrues over 61k$ of cumulated incentives per week and the TetuBal/BALwETH pool is incentivized following the terms of Humpy peace treaty.

veTetu specs :

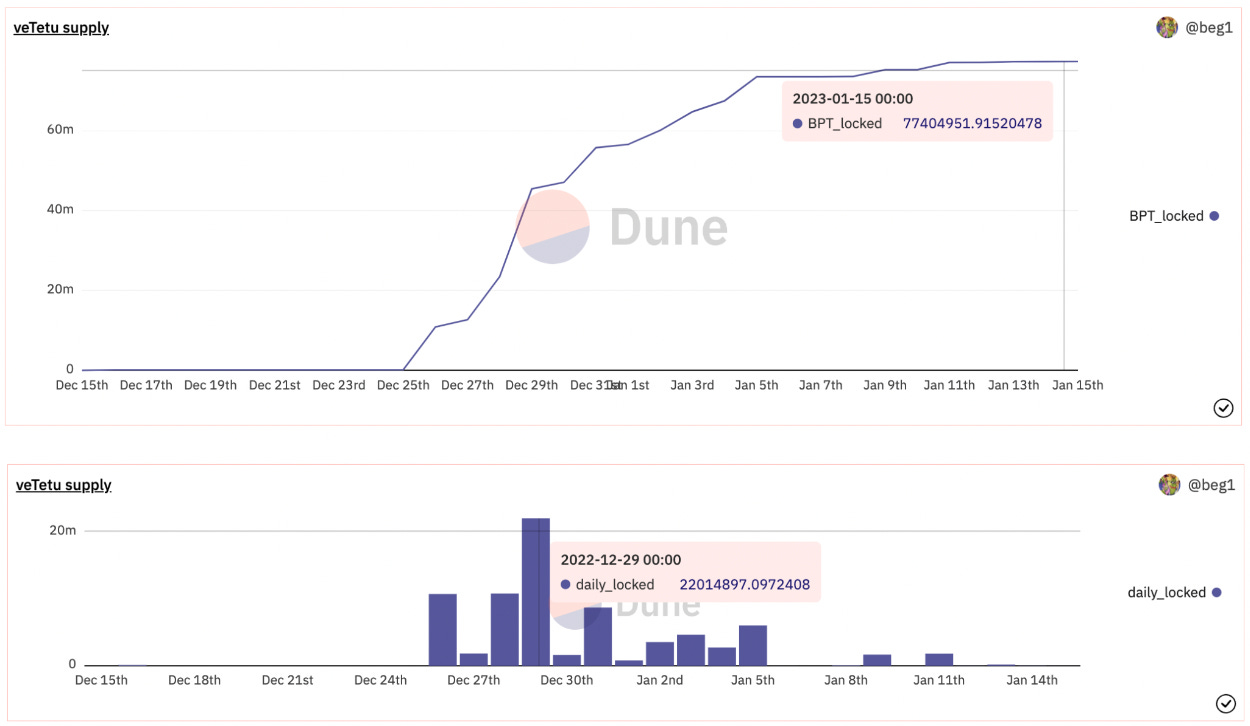

Most dxTetu were migrated to veTetu between Dec. 25th and Jan. 5th ; which results in a total supply of almost 80M veTetu.

One interesting note is that the veTetu contract is deployed with an upgradable proxy which means veTetu design can be updated with new integrations.

The initial design of veTetu allows holders to Merge or Split veTetu to maximize locking multipliers, thanks to ERC-721 NFTs. This technical particularity will be at the heart of most Tetu Improvement proposals posted since then, and seems like a great setup to create new use cases for the token.

Tetu Community big brain-storms :

Using tetuBal backstop reserves to tokenize the tetuBal peg :

https://discord.com/channels/854689587027640351/1058888375324647477/1058888375324647477

An innovative iteration on the path to strengthen the peg of liquid lockers wrapper token would actually be to tokenize it. The way Zagiri introduces it would provide a use case for potentially idle reserves accrued by the protocol, increasing the incentive to deposit BAL/wETH BPTs into the protocol and creating a 1:1 backing mechanism to TetuBal holders.

We can clearly observe a pattern where the focus is put on creating new revenue sources, most of the time by opening liquid markets on governance rights and incentivizing market-making delegation.

Without centralizing the power, DAOs managed to adapt their model and enhance participation through DeFi native innovations. However, regardless of how well designed or how many flywheels your tokenomics puts together, the production costs will ultimately exceed revenues without a supercharged yield source to fuel it.

Voting Incentives

The smart builders behind Tetu quickly understood the role of voting incentives within governance markets and were fast to adapt their cash flows to take advantage of such external sources of revenue.

It has several benefits and opportunities - first, it allows the creation of new DeFi stack use cases for locked BPTs.

TIP-014 - Allowing deposit veTETU BPTs into gauge :

Work in progress

Overall, many proposals are seeking ways to implement a revenue sharing mechanism, while -as mentioned multiple times on the TIPs discord threads- it would empirically take a lifetime given the current rate to raise the revenues at a sufficient level only through BAL incentives.

Recently, a consensus seems to indicate that a new type of asset class can gather enough liquidity and further iterate on the work initiated by Curve to separate technical and economics matters at the token level, this asset class is NFTs.

You can find more details on the bullish thesis on NFTfi for 2023 with the excellent thread by @0xPrismatic at :

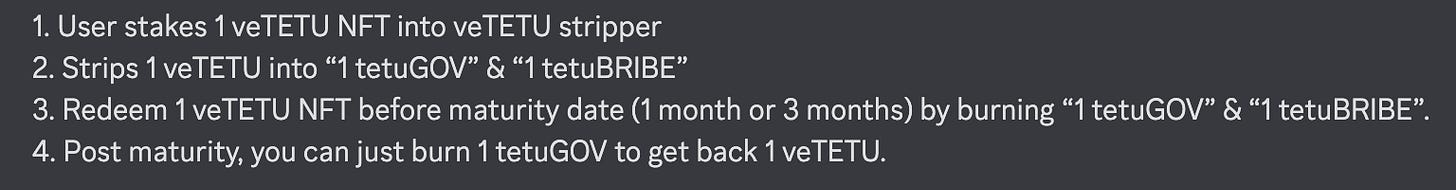

Regarding Tetu, the community member @YJN figured out an interesting utility for veTetu NFTs as described in the scheme below :

https://discord.com/channels/854689587027640351/1060430806352396298/1063505494314074162

This implementation would protect governors aligned with the project, by separating the voting power and revenue sharing by the protocol, while allowing the opportunistic bribees to arbitrage the cost of veBAL on AMMs such as Uniswap v3 alongside with the delegation market makers.

In conclusion, the veTetu is designed to be upgraded and iterated on as the project develops. As more projects migrate to layer 2 and implement ve-governed designs, we can expect Tetu to continue to be a key player in the governance yield farming narrative. The community is actively working on new revenue sources and use cases for the token, positioning Tetu for long-term success in the DeFi landscape.

Meanwhile, to achieve maximized revenues, veTetu holders can now delegate their voting power to Paladin’s address [ paladin-voter.eth ] here. Readers can learn more about the delegation and relates steps in docs.