Weekly Gauge #27 : The Philosopher’s Stone - veALCX

Latest discussions on Alchemix ve-style governance

Alchemix Finance is a DeFi protocol that introduced the innovative primitive of self-repaying crypto lending. Alchemix loans pay for themselves by using your collateral to produce farms on yield-bearing DeFi protocols.

As if self-paying loans weren’t originally radical enough for a lending protocol, Alchemix goes one step further. The crypto loan you receive is based on the future yield value of your collateral in form of a synthetic mirror token. In essence, the protocol deposits your collateral in other protocols and tokenizes your interest now for what your collateral can pay later. During v1, ALCX token was purely intended for governance. But recently a tokenomics update was proposed by the core team to adapt ALCX to a ve-token system. This week, we’ll be delving into its specificities:

An 80/20 BPT as veToken

“veALCX stakers will need to LP on Balancer, in a pool that is 80% ALCX and 20% ETH. 80/20 pools enable liquidity provision where LPers are still primarily exposed to ALCX, and IL is substantially reduced.”

We can observe a solid trend of protocols choosing 80/20 LP assets as underlying token for their governance framework (both Tetu and Paraswap have also incorporated it), this represents an opportunity for Balancer to adapt its product market fit and onboard a whole new type of project to the Balancer Wars. Do note that Balancer is fully aware of this opportunity and is currently voting on a grants program rewarding 80/20 BPT veSystems.

“veALCX stakers will be able to vote on bi-weekly gauges”

This fits better with Liquid Lockers' voting framework and should increase voters’ coordination.

Liquidity Migration

The transition from Sushiswap 50/50 pool to a Balancer 80/20 implies substantial changes to the LP dynamic and requires a well-designed strategy. A proposal regarding the migration of ALCX Liquidity to an ALCX/ETH Pool on Balancer is currently being written and open to modifications, but we can already highlight some notes :

source: (AIP-XX Creation and Migration of ALCX Liquidity):

A full revamp of the cashflow for holders

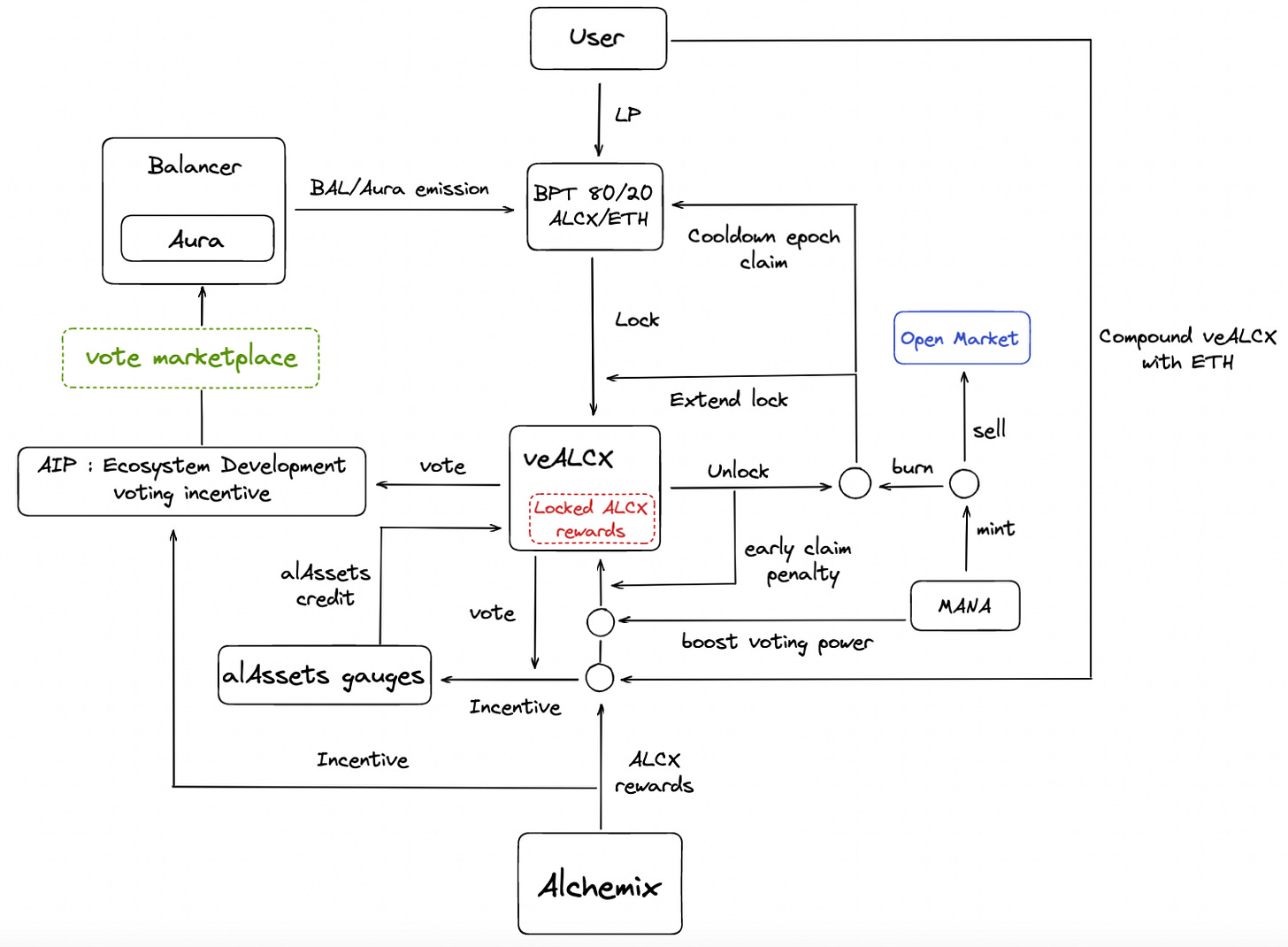

Source: Author’s interpretation

The above scheme is a comprehensive representation of the role and specifications of the veALCX token, at the heart of the relationship between Alchemix protocol, its users, and the surrounding protocols (such as Balancer and Aura) whose incentives programs can boost the capital efficiency of the new ALCX tokenomics design.

4.1 Vesting rewards (Red Box)

veALCX stakers incentive is subject to the same locking terms as their veALCX BPT token — ie, unlocking BPT will also unlock ALCX. Alternatively, at any time a user may choose to exit early against a 50% penalty, which will be redistributed to other veALCX lockers, further incentivizing long-term alignment.

This locking mechanism also flywheels with the possibility to compound the veALCX yield by adding the BPT balance in ETH, which deepens the liquidity pillow of the token.

Source: alchemix-stats

*39% of emissions are being redirected to the Alchemix treasury, meaning the tokens do not enter circulation.

**20% of current ALCX emissions represents 1948 $ALCX ⇔ 28.8k$/week ⇔ 1.5M$/year that are locked or compounded into veALCX to enhance the governance participation and long-term commitment.

4.2 The Mana Token (Blue Box)

Mana use cases are respectively : Boosted veALCX power / Early veALCX unlock / Secondary market.

Considering that final calculations for boost multiplier haven't been released yet, we’ll focus on the relative pricing of early exit and claim use case.

One interesting take is that the price of MANA on the open market should be arbitraged naturally by the real underlying yield generated by veALCX. Assuming that the cheaper option between buying MANA or forfeiting 50% of the rewards would always get chosen here.

The mana token, as a utility token, can be a valuable and useful primitive in a decentralized platform because it can be widely composable and enable a lot of future additional use cases.

By tokenizing a boosting mechanism, it allows for more flexible ways to use it, and also creates a more efficient system, as holders are now able to trade it freely, therefore creating a market for this token, aligning the incentives, making it more efficient and fairer.

If we were to be picky, Mana has been too widely used and the name could be more original. We like BRASS : Boosted Rights Alchemix Social Share as a reference to the famous metal used by alchemists.

4.3 Supercharging emissions with a vote marketplace (Green Box)

The intent to get a Balancer gauge for the ALCX/ETH pool would allow it to be incentivized at the governance level through voting incentives instead of simply emitting ALCX. This will require the use of a vote marketplace such as Paladin Quest but will significantly raise the yield for LPs.

Considering the high dilution rate of veBAL voting power it seems more accurate to incentivize votes and accrue BAL and Aura through POL farming rather than exclusively buying and locking Protocol Owned veBAL.

Detailed calculations have been shared directly to the team regarding cost of voting incentives to ensure matching current revenue rates.

******************

Finally, as announced in the veALCX update medium, work is still in progress on some important details of Alchemix’s new governance framework, however, a lot of innovative mechanisms are put together and fits very well with the project’s needs.

Delving into Alchemix’s tokenomics revamp is a good opportunity to explore some extremely interesting iterations of the ve-token model. We can’t wait to see how successful this implementation will be!

Personal note: Alchemix Team and Community are very quick to answer questions and provide links or paths to find data. Much appreciated!