The real and lasting victories are those of peace, and not of war. — Ralph Waldo Emerson

Since the implementation of the gauge framework within the Balancer ecosystem, an individual or small isolated group nick-named Humpy Dumpy has gradually risen to the level of veBAL's largest holder by composing its interests and regularly buying significant amounts of BAL on the market.

At the same time, a veBAL liquid locker called Aura Finance has brought together a coalition of voters with the aim of replicating the synergy existing between Curve and Convex.

The relationship between Balancer and its two biggest holders has unfortunately not always been fully symbiotic, as both parties didn’t seem to have been able to establish a direct line of contact. This led to tensions, which climaxed over clashes in the forums on governance procedures.

Knowing both parties have tens if not hundreds of millions of dollars at play,it quickly became obvious finding a way to co-exist would be infinitely more profitable than fighting. Which is why it came to much relief to everyone when an agreement was found.

Now that Balancer is potentially entering a golden era of peace and prosperity, let's analyze the potential outcomes to some very interesting statements of the treaty.

The rise of a duopoly:

Humpy will keep pushing Tetu’s growth, which is going to mean both Tetu and Aura are going to thrive on Balancer. The rise of this duopoly means Balancer is going to go off-script, for people using the Curve play-book as a way to understand its evolutions and opportunities.

While many used to bet that Aura would become the equivalent of Convex regarding market shares on veBAL and user base, we can already affirm that this proposal is setting the field for a more competitive duopoly between Tetu and Aura. However, this should not be perceived as a threat for both protocols.

Actually, it might be a new iteration in the development of the gauge framework, empowering layer 2 liquid lockers with the vision of a transition from mainnet to multi chain governance activism. This should also increase the trading volume and TVL on L2 pools, which is a very big project for Balancer and it’s Friendly Forks program.

A safeguarded price action:

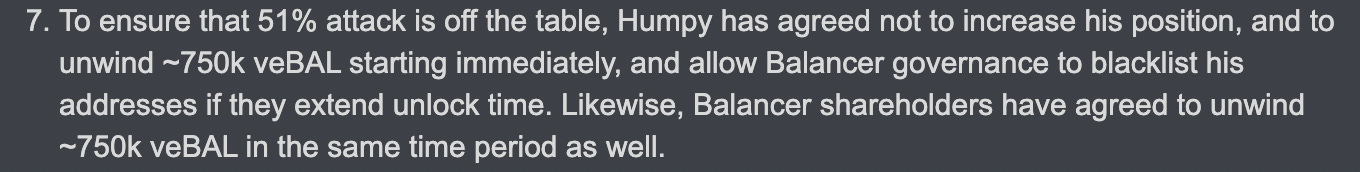

Another important piece of news is that Humpy and a few Balancer shareholders have agreed to exit a significant part of their positions. This means, the emissions/veBAL will grow by double digit % when it happens.

Additionally, Humpy has agreed to exit his unlocked positions as gently as possible probably via an OTC deal, which will not affect the price action.

The golden era of Balancer vote incentives:

Humpy is estimated to own over 30% of all veBAL. His participation in vote incentive campaigns is excellent news both for projects currently participating in the Balancer Wars and projects currently on the sidelines.

Current incentives are going to get diluted until emission prices by this new participant who will act as a Vote Market Maker. Additionally, projects looking to participate in the wars will have a significant amount of extra incentives to compete for.

All in all, Paladin’s LightQuest feature is being releaseded at the perfect time to enable new projects to acquire these votes exclusively, while also preventing reward dilution on major bribes marketplace that would prevent them from getting Humpy votes.

To finish this newsletter, we would like to thank all stakeholders who made this deal possible as it will truly push Balancer into a brighter era that we cannot wait to be a part of.

Author’s side-note:

“If we apply this reasoning to the current Balancer situation to counteract the supply distribution problem, the use of liquid wrappers should be bootstrapped and the impact of organic veBALs diluted.” - Weekly gauge 15