In the introduction article of our mini series on the new generation of decentralized stablecoins carried by the launch of Curve’s $crvUSD and upcoming one Aave’s $GHO, we introduced a promising alternative to centralized counterparts, aiming to provide enhanced stability, efficiency and resilience in the lending market.

This second part will focus on capital efficiency for farmers by analyzing the composability of lending oriented stablecoins

crvUSD analysis

On June 8th, the lastest $crvUSD related governance proposal passed, allowing to deploy wstETH market with 150M crvUSD debt ceiling and increase PegKeepers limits to 25M crvUSD each. This represents another step toward increasing the decentralized asset dominance, although it still has a long way to go before taking the lion’s share of the stablecoin market.

https://dao.curve.fi/vote/ownership/347

chart courtesy of crv.mktcap.eth article

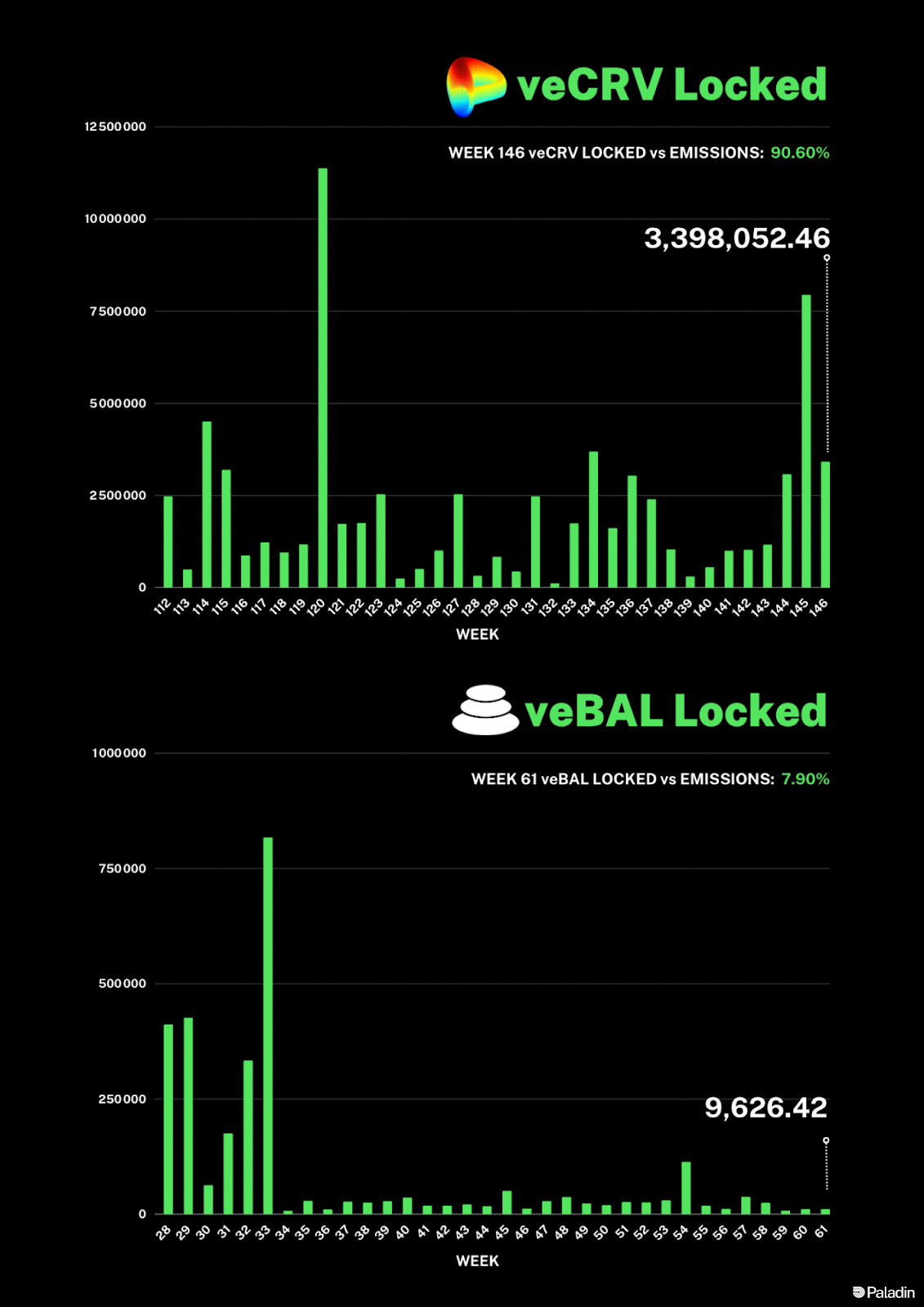

In terms of revenues for the project, $crvUSD currently generates 2 million a year distributed to $veCRV holders, at current max capacity and current interest rate it can generate up to 10 million, for comparison this represent 2% to 10% of Curve total historical trading fees revenues with only 1.2% of the total TVL.

By design, LLAMMA is the first and primary line of defense to maintain crvUSD’s peg to $1 as the mechanism is designed to keep all crvUSD debt sufficiently collateralized.

Moreover, the stable’s resilience relies on algorithmic market making interventions from 4 PegKeepers that have the capabilities to decrease or increase the crvUSD price feed used by the token oracle during periods of price deviation, by withdrawing + burning it or minting + providing it to the stablepools responsible for the price feed.

https://twitter.com/CurveFinance/status/1667446799290843138?s=20

To further the efficiency and decentralization, PegKeeper actions defined in the contract can be called by any external caller, enabling them to earn profits in the form of LP tokens.

The development of risk isolated lending markets like Silo Finance brings the opportunity to borrow with LP token collaterals, this contributes to offset the fundamental flaws of over collateralization or interest costs by stacking yield layers for capital efficiency, as well as increasing the composability of both the lending platform and the stablecoin issuer, eventually driving buying pressure on the LP underlying assets.

https://twitter.com/SiloFinance/status/1668280743292977152

Amidst the large room for composability with new integrations such as LP token collaterals, the efficiency of stablecoin lending markets will also be made possible by user friendly protocols such as Conic Finance allowing investors to avoid the struggles of actively managing their liquidity while maintaining high yields on stable assets.

Conic Finance

Since it launched less than two weeks ago, the $crvUSD omnipool available on Conic Finance attracted over 70% of the asset market share with $26.1M supplied over $32.57M total debt. Note that the protocol recently crossed the $100M total TVL milestone.

https://twitter.com/bb8_cnc/status/1668240605082779648?s=20

Conic introduces the concept of "omnipools," which offer users the ability to deposit their assets into Curve and distribute them across various pools. By creating a flexible pool of capital, it can seamlessly move between Curve pools and Convex staking to identify the most lucrative yield opportunities.

This functionality becomes particularly valuable when considering the possibility of collateral liquidation within the crvUSD ecosystem. In such cases, the omnipool can redirect its focus to the corresponding pool, absorbing rewards. (Courtesy of Adam Cochran)

https://twitter.com/FungiAlpha/status/1668225410436587520?s=20

Curve’s synergy with Conic rely on the variety of crvUSD pools as well as the ability to provide high yields sustained with volume and arbitrage. Moreover, Curve can leverage its governance power to maximize yield on this specific asset through Conic emissions.

for more detail on Conic value proposition and market fit I suggest reading this very insightful thread from user 0xdaesu :

https://twitter.com/0xdaesu/status/1661861316099801094?s=20

In the same fashion as it participates to Curve’s ecosystem, similar fundamentals should bring more efficiency to the up and coming opportunities on Balancer’s ecosystem.

GHO boosted pools

Another DEX which consistently offered high farming yield for stable and pegged assets during the past few months is Balancer with their unique boosted pool design, creating high capital efficiency by enabling users to provide swap liquidity for common tokens while forwarding idle tokens to external protocols. This gives liquidity providers the benefits of interest rates from lending markets like Aave on top of the swap fees they collect from swaps.

The launch of GHO will most likely be bootstrapped with the creation of multiple pools leveraging the new Aave’s stablecoin, which combined with the efficiency of boosted pools will offer enough diversity to make it worth creating a yield aggregator similar to Conic.

The value proposition of a Conic like protocol for the Balancer ecosystem could be beneficial to the GHO flywheel by allowing $AAVE stakers to enhance the power of their borrow discount while leveraging the same capital efficiency as with crvUSD.

In conclusion, the potential to set new standards across DeFi and further establish ETH liquid staking derivatives as the default base token, encourage stablecoin issuers and lending platforms to adopt new disruptive emission and liquidation mechanisms, pushing a new iteration toward decentralization, which have the potential to drive a long lasting narrative harnessed by a new wave of superDapps as other major DeFi protocols.

In the meantime, the Omnipools will assert dominance as a great vertical to lending oriented stablecoins and liquid staking derivatives.

—-------------------------

Side Note : The Weekly Gauge newsletter just crossed the thousand readers milestone !

@Paladin Team and especially our writer and co-writers want to express their gratitude for the support highlighted by this achievement.

It might be the appropriate time to hint that work is in progress behind the scenes to build an honorary piece of content thanking all data visualisoors whose work contributed to the newsletter.