On Curve :

Convex incentives budget is changing as it goes cross chain. A new incentive framework was introduced to split emissions between voting incentives and gauge emissions based on vlCVX weight. In fact, it seems very accurate to replicate Frax’s strategy to coordinate or internalize both sides of the governance markets, this could lead to an automatization of the market-making on the platform

https://convexfinance.medium.com/november-2022-convex-goes-cross-chain

On balancer :

The agreement reach between Aura, Balancer, and Humpy that we’ve covered in the weekly gauge #23 appears to be already implemented, as the TetuBAL gauge weight climbed to the top, even above the Lido metastable wstETH/wETH gauge.

Source : https://app.balancer.fi/#/ethereum/vebal

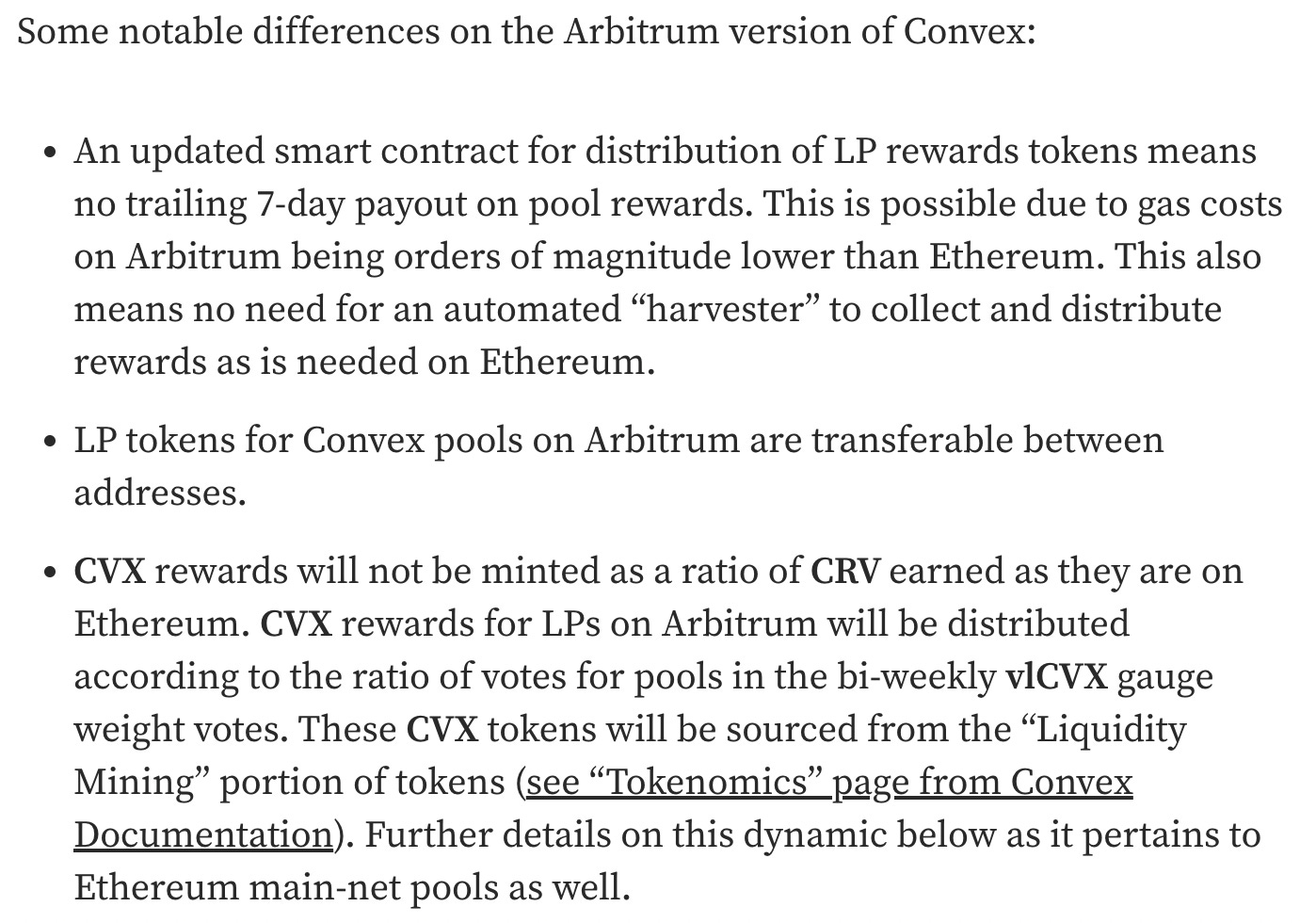

Regarding voting incentives, all bribes have been flattened to the same 0.04$/vlAura ratio, which does not represent any issue if the distribution of gauge weights remains aligned with TVL. Tracking of this metric with excel mainly highlights the need to increase incentives on L2 gauges, which will probably be enhanced by the rise of Tetu.

Source : HiddenHand marketplace and Author’s calculations

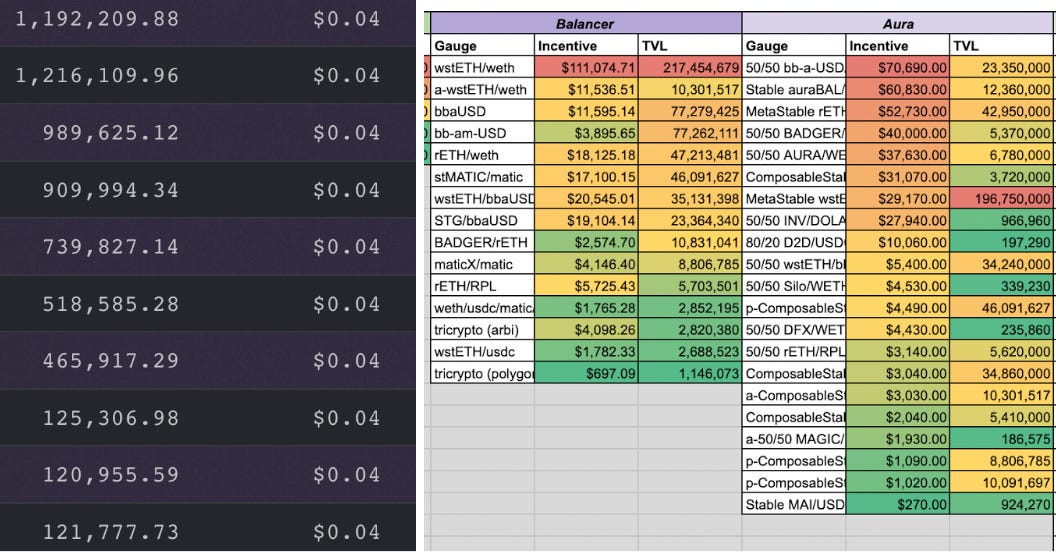

However, we can observe on Aura’s Snapshot proposal for the 8th December gauge weights that Humpy didn’t allocate his vote to contribute to flattening the $/vote ratio, thus he is not responsible for the linear rebalancing.

Humpy gauge votes for Week of 8th December

Finally, despite all the improvements brought by the peace treaty, the community highlighted one additional take regarding the unwinding and non-acquisition agreement of veBAL voting power by both parties. During the coming weeks, the BAL token price action might shape the lines of a long-term trend.

On Frax :

Since FIP-16 veFXS gauges and per the original design specs for FXS distribution, the FXS emissions halve every 12 months on December 20th each year. Unlike Curve or Balancer that opted for a slowly decreasing bonding curve, Frax went with a massive 50% cut in the emission rate, lowering it this time to 6,250 FXS/ day to gauge emissions and 4,109.59/ day to Uni v2.

On the other hand, the 17th edition of the Weekly Gauge highlighted the fact that $FXS voting incentives accounted “for over 50% of Votium cash flows and 80% of the total available bribes count”, so far the Frax related gauges hold a strong dominance.

Nevertheless, a substantial part of cvx's power is controlling fxs emissions on fraxbp, which could make it become less interesting for daos to buy cvx to push their fraxbp.

Recent peg issues on wETH and wBTC opens the door to FrxETH as Sam Kaz stated in the flywheelpod podcast