Weekly Gauge #13: Bribes Game Theory - Part 2

Non-Cooperative Games, - introduced in the previous edition - focus solely on the payoffs to the individual and searching for stable equilibrium solutions. By contrast, Cooperative Games add an extra dimension to the setup: players now have to think about the payout to the whole organization. Here, instead of individual payoffs, we have to look at both the positive and negative externalities the actions may have on the whole system.

For permissionless blockchain-based platforms such as Curve Finance, the technology has to increase the connectivity between the agents and potentially achieve a higher degree of interdependency between them. Creating positive interdependency between elements can be achieved by designing sustainable incentives mechanisms in the system.

The scheme above represents the structure of the extensive game taking place between the participants of the bribe incentives market. The first node is the event of a new bribe being created. Then, two situations can happen: the bribe will be overpriced or underpriced relatively to the underlying yield of acquired votes. This will only be known at the end of the round (except for Paladin’s Quest) .

Players are vl Holders and Delegation Addresses. An information set is a collection of nodes that are controlled by the same player, but which are indistinguishable for that player. In other words, the decision of vl Holder to Bootstrap, Sustain, or Protect Supply is indistinguishable for the Delegation Address. Therefore, payoffs will depend on the strategic allocation of its voting power.

Note that the various decisions, or strategies, correspond to :

Bootstrap = Mercenary votes towards high yield bribes

Sustain = Liquidity provider directing emission to their pool

Protect supply = Voting power allocated according to pools volume

In order to understand the macro-economic trends that rule the governance wars, it is necessary to acknowledge several factors which directly impact the market price of bribes. Let’s assume the market as one entity :

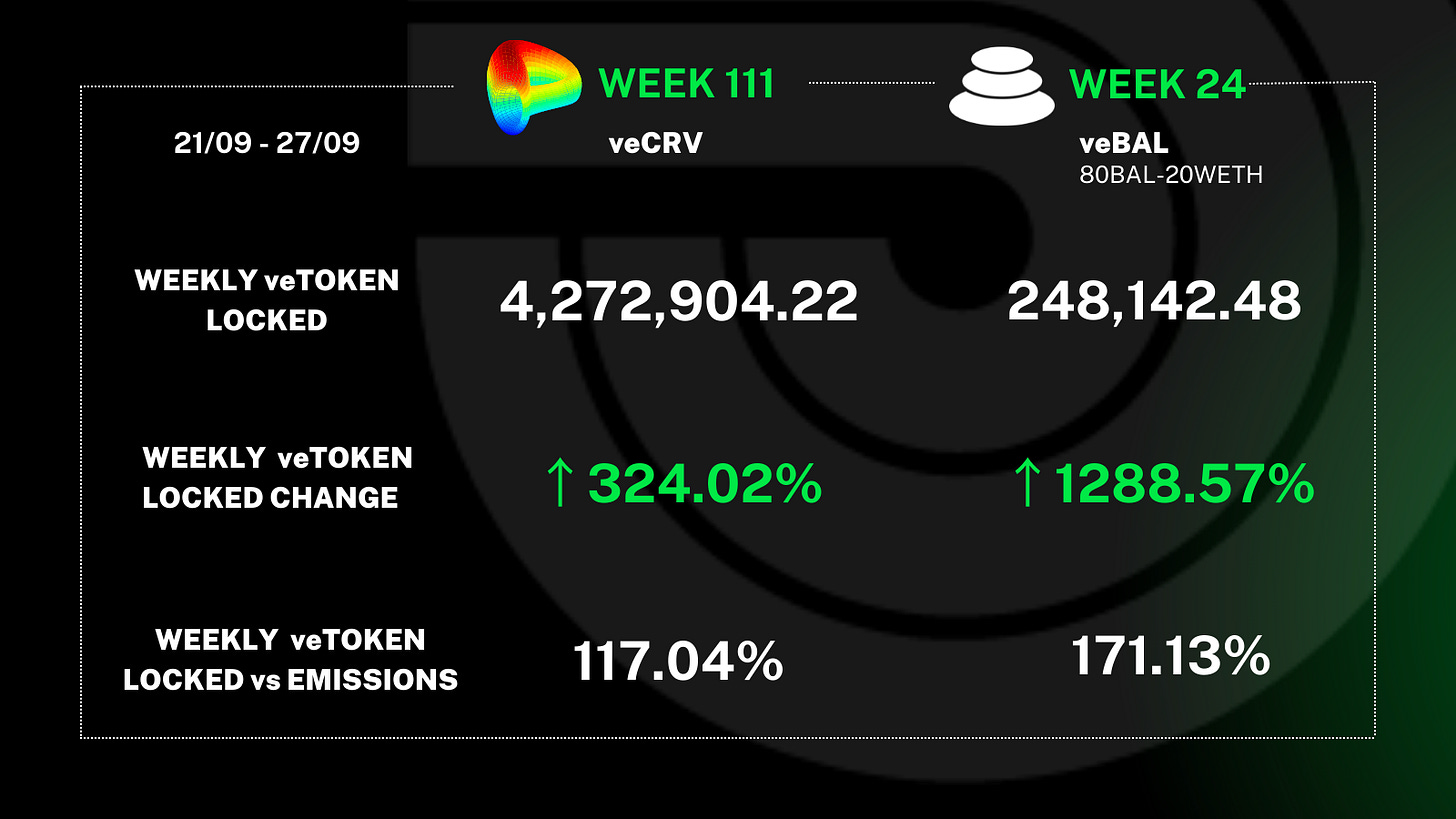

1. Constant dilution pressure is created by the veCRV lock rate :

Average lock rate (10 weeks) = 2,025,325.08 veCRV/week => 0.4% weekly dilution

More votes + same incentive value => less $/vote

2. If incentives increase more than veCRV dilution => $/vote increase (votium style) :

Thanks to the total volume per round ($2.9M) as well as the average price per vote ($0.06327), we can calculate the average user base of votium in terms of vlCVX (46.9M). The graphic below displays the correlation between the overall value of incentives per round and the price per vote.

Source: Author’s Calculations

3. If incentives decrease and veCRV increase => double dilution $/vote :

Currently, the Votium delegation address cast votes at the very end of every round in order to balance each bribe $/vote ratio on their platform. Moreover, it controls around 40% of vlCVX voting power which represents 20% of total veCRV voting power.

Since we know the delegation address’ share of the total vlCVX voting through Convex, as well as the total value of each bribe, we can make assumptions on its allocation mechanism. The table below highlights that vote allocation is highly correlated to the total value of a Bribe. However, it doesn’t take into account the revenue generated by the pool on Curve Finance.

Source: Author’s Calculations

We can observe that the distribution of all ($/vote) ratios, on a comprehensive set of Votium bribe rounds, follows a Normal Law. However, we can affirm that the total amount in $ of a bribe doesn’t impact its final ($/vote) ratio. This means that projects can’t build sustainable mechanisms only based on the original value of the incentive campaign.

By design, Quest allows bribers to set-up a predictable ($/vote) ratio, and the Paladin team supports Questors by advising the most efficient rate to fit their project’s needs. This product can be defined as a hedge against short term volatility which also incentivizes voters’ long-term alignment.

Recently, Convex voters became eligible to participate in Quests. Moreover, to simplify the earning process, vlCVX holders can delegate their voting power to Paladin’s convex.palvote.eth address to optimize bribe yield by having access to all bribe marketplaces. There are zero costs outside the gas to delegate. The delegation is also possible directly through accessing Warden Dapp - in the top right of the screen you will see the green button [Delegate].