Weekly Gauge #10: Bribe Game Theory

Like any good portfolio manager, treasury teams build their incentive strategies by analyzing market metrics that allow them to budget their spending according to the market trends. In order to make relevant decisions, they completely rely on the accuracy of calculated ratios using available data.

Several free-to-use dashboards track records of every voting round's incentives and facilitate ratios to help bribers quantify their performance. However, is the displayed data really accurate?

Recent studies show that, on average, 50% of voters aren’t participating in the bribe incentive campaign - it sounds obvious that we should deduct this fraction from the overall count of participants, but somehow most of the time it is not the case.

https://dune.com/tianqi/Balancer-Gauge-Bribes

The given situation can be studied from the game theory perspective:

In a cooperative game with transferable utility, it is assumed that the earnings of a coalition can be expressed by one number. One may think of this number as an amount of money, which can be distributed among the players in any conceivable way. More generally, it is an amount of utility and the implicit assumption is that it makes sense to transfer this utility among the players – for instance, due to the presence of a medium like money, assuming that individual utilities can be expressed in monetary terms.

We can easily distinguish a cooperative game in the bribe economy in which two coalitions are competing. On one hand, we have the bribees (who take advantage of voting incentives) and, on the other hand, the loyal or organic votes (who don't rely on bribes to direct their share of emissions).

In order for the system to remain sustainable and to reach the Nash Equilibrium, the votes should naturally be allocated according to the share of revenues generated by each pool. However, empirically this isn’t true. Such a case leads to capital inefficiency on both bribers and protocol sides.

Although we have witnessed various examples, such as Balancer’s Cream or GraviAura gauges, that highlights this issue, it also came with its own set of information discussed below.

The largest pools in terms of TVL are mostly made of stable or low volatile tokens and liquidity providers are whales who don't rely on bribes. Instead, they use liquid lockers that offer to maximize their boost, without the need to own a ton of veTokens. However, the weighted share of emission directed to those pools does not fit with the revenue share that it generates.

This can be explained by the mercenary behavior of around a half of the governance participants willing to earn their yield on bribes rather than on protocol fees. By offering an arbitrary and volatile incentive to voters, bribers and bribees do not contribute to the sustainability of the underlying source of value creation that is the zero-sum plus fees model of the decentralized exchange.

However, while being unsustainable on the long-term vision, this mechanism has shown to be a really good lever to bootstrap a pool and can help new players to attract a lot of market shares and TVL.

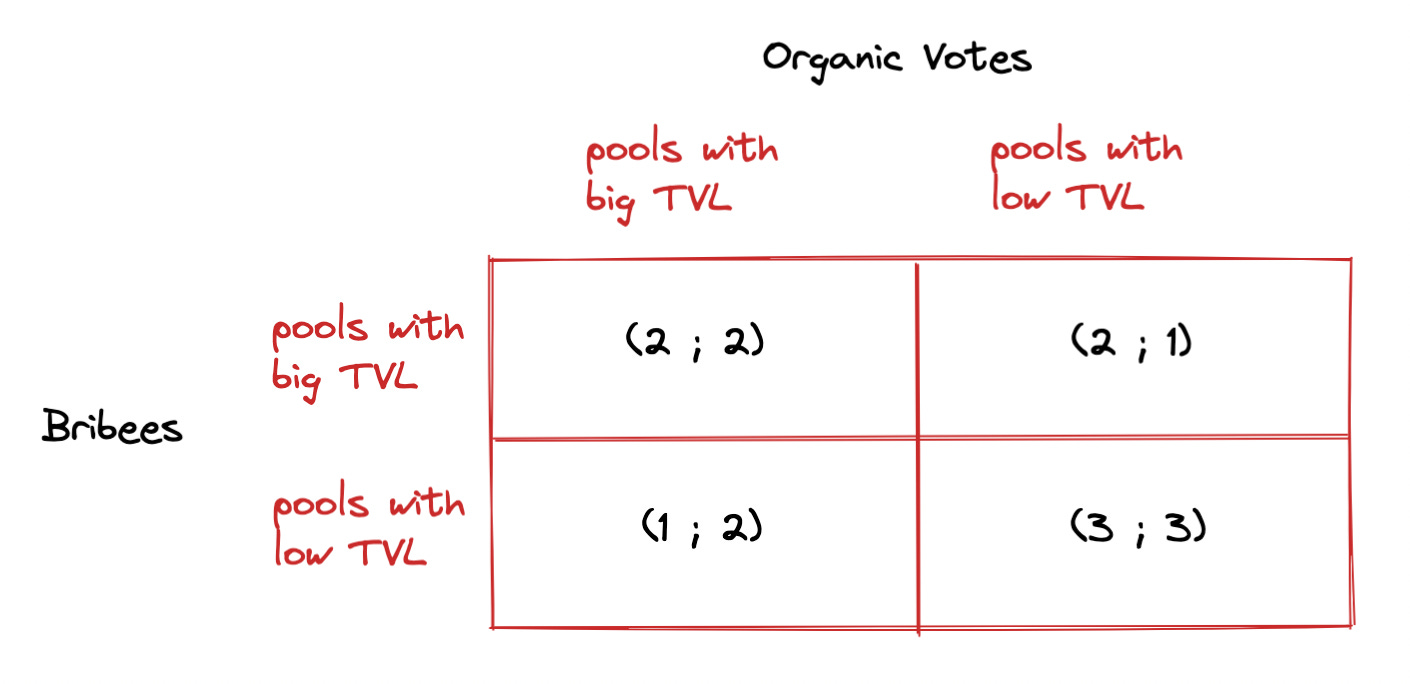

The below illustration represents so-called “Pay-off matrix”:

Nash Equilibrium for Governance wars (Assume Organic Votes are also Liquidity Providers) :

(2;2) > Win-win situation for participants

(1;2) (2;1) > Worst case for at least one participant

(3;3) > Nash Equilibrium, best case for both participants

This scheme highlight the fact that despite being a win-win solution for bribees and organic voters to allocate their share of the emission to the biggest pools, they are more incentivized to direct it to the smaller pools that will generate a substantially less diluted APY. Hence, this mechanism is not naturally oriented towards the protocols needs, however, a well designed incentive distribution could help to match everyone’s expectations.

Paladin’s Quest dapp allows bribers, liquidity providers and voters to align their expectations with the long-term development of the DeFi ecosystem and to get closer to the so-called Nash Equilibrium of incentives and revenues. This can be achieved by including fixed rate incomes and floor levels of desired emission for each pool, that matches every stakeholders needs.

That being said, it is still important to mention that more and more users seem to align with protocols' long-term visions as Balancer’s lock rate keeps increasing sharply. Curve’s rate may look like it’s slowing down but we need to keep in mind that the previous weeks have seen huge locks.