Since we posted Weekly Gauge #82 , we observed a growing interest and mindshare for Sonic apps and the Sonic ecosystem, with a surge of engagement on threads and posts on socials. The Rings Twitter account has just reached 4,500 followers and continues to grow, demonstrating increasing community engagement and awareness.

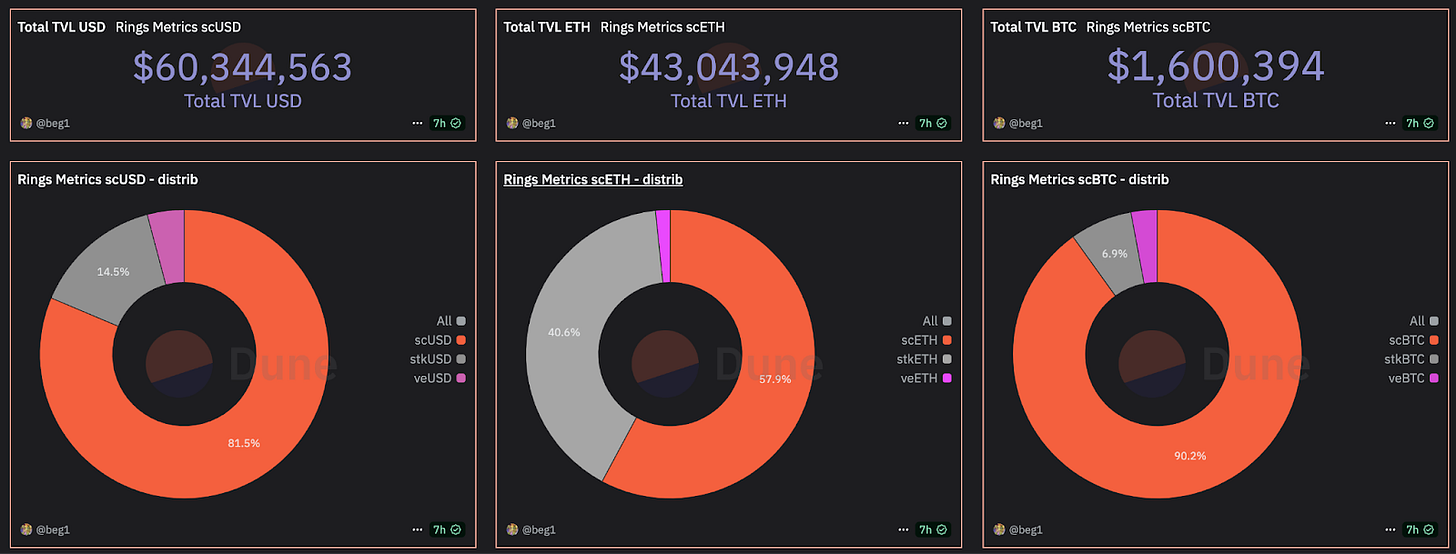

Rings has recently released its BTC module featuring scBTC as well as staked and locked versions, which has already accumulated over $1.5M in TVL.

We have demonstrated many times that vetoken models generate yield for governors correlated to voting incentives volumes. Quest vote marketplace for Rings is starting to generate volume (around $6,000 weekly), but how much more can it grow? This question lies at the heart of understanding Rings' long-term potential and sustainable yield generation capabilities.

Rings Gauge Tokenomics

It's important to remember the market strength of veUSD/ETH/BTC compared to native token models. Using wrappers of major assets such as stablecoins, ETH or BTC, as governance tokens is much more powerful and counters market inefficiency of gauge models based on native token and emissions, because the dilution and volatility is so much lower with Rings model that people can farm up to 3-figure APR with the simplest and most secure market exposure.

The real yield characteristics (underlying yield sources) are a key differentiator for Rings. The yield redistributed through Rings gauge governance as mentioned above does not rely on emissions or inflation, instead it is more similar to revenue sharing from the scAssets underlying yield. It is real yield because the farmed rewards are consolidated in stablecoin or major assets before being redistributed.

On Rings, a gauge corresponds to a project treasury address. Now more than 12 gauges corresponding to 12 different protocols treasuries are whitelisted to capture a share of the rewards farmed by Rings TVL. This diversity of gauges provides users with multiple options for directing protocol yield while ensuring ecosystem-wide benefits.

Efficiency Metrics

Rings TVL has surpassed $100M, representing over 150% week-to-week increase, with growth entering a parabolic phase. This exponential growth trajectory demonstrates strong market confidence and increasing capital inflows into the protocol.

Track Rings data on Dune: https://dune.com/beg1/sonic-rings

Double the TVL means double the yield to redistribute via veUSD & veETH, creating a virtuous cycle where growth directly translates to higher returns for governance token holders.

Over 400,000 veUSD split between 1,900 holders controls projected roughly $40,000 every week, or $0.10/veUSD per week. Assuming the bribe market for veUSD would cap for a minimum 50% efficiency, that would still represent 260% APR for veUSD, an exceptional return for a stablecoin-based governance token.

Track veUSD metrics on dune: https://dune.com/beg1/rings-veusd

Almost 65 veETH split between 470 holders also controls projected roughly $40,000, or $615/veETH, with the same vote incentives efficiency assumptions it's a whooping 640% APR for veETH, the highest ETH yield ever seen since DeFi Summer. These unprecedented returns on major assets highlight the efficiency of the Rings model.

In conclusion, more and more Sonic projects are whitelisting gauges on Rings to capture extra rewards for their protocol users, creating an expanding ecosystem of participating protocols. Quest is the exclusive marketplace for Rings so all the volume will go through it and serve Paladin DAO, establishing a centralized venue for gauge voting and incentives. The increasing mindshare of the Sonic ecosystem is a catalyst to Rings value distribution, and as vote incentives grow, Rings is becoming the leader for stablecoins and major asset real yield farming, cementing its position at the forefront of sustainable DeFi yield generation.

Waterfall