Fantom's Supersonic Comeback

After a lengthy period of bear market -conducive to build behind the scene-, Fantom Network in more than just a rebranding, totally evolved into Sonic, entering the bull with numbers of innovations to foster scalability for users and reduce operating costs for validators.

“Designed by Professor Bernhard Scholz, one of the world’s foremost experts on virtual machine development, and his team, and led by DeFi pioneer Andre Cronje, the Sonic chain is a new layer-1 chain with a native layer-2 bridge connected to Ethereum.”

“The technological advancements we achieved with our Sonic technology could not be fully integrated into Opera through a simple soft-fork upgrade. Therefore, we decided to launch an entirely new network with a new token, allowing us to usher in the next era of L1 blockchain innovation.”

In today’s weekly gauge, let’s walk through one of Sonic’s core applications, designed to become the main attractor of liquidity from Ethereum mainnet to Sonic and simultaneously the main distributor of incentives to support Sonic apps ; Rings, by the builders behind Paladin.

A Sonic core product (native meta-stable primitive)

Sonic positions itself as the fastest settlement layer for digital assets with over 10,000 TPS and one-second confirmation times for transactions, aiming to attract the masses and make blockchain technology accessible to mainstream adoption.

As we highlighted in weekly gauge #78, the stability primitive is one of the primary bricks for a financial ecosystem to develop on-chain. Facilitating exchanges and providing an edge to volatility for DeFi users (from yield farming to lending and leverage strategies)

Rings introduces scUSD and scETH, respectively wrappers for stablecoins and Ethereum derivatives on Sonic, allowing holders to bridge and natively generate high yields with widely adopted assets

More than a yield farming protocol, Rings coordinate all apps deployed on Sonic by providing them rewards to distribute to their users. Fueling DeFi on Sonic with a scalable and sustainable incentivisation mechanism.

Rings design

Rings is designed as a great liquidity attractor from Ethereum ecosystem toward Sonic, providing users with meta-stable assets unwrappable 1:1 for the underlyings ETH and stablecoins, generating high yields, and above all creating a new utility for these major coins by giving it voting power over the distribution of incentives among all dAPPs on Sonic.

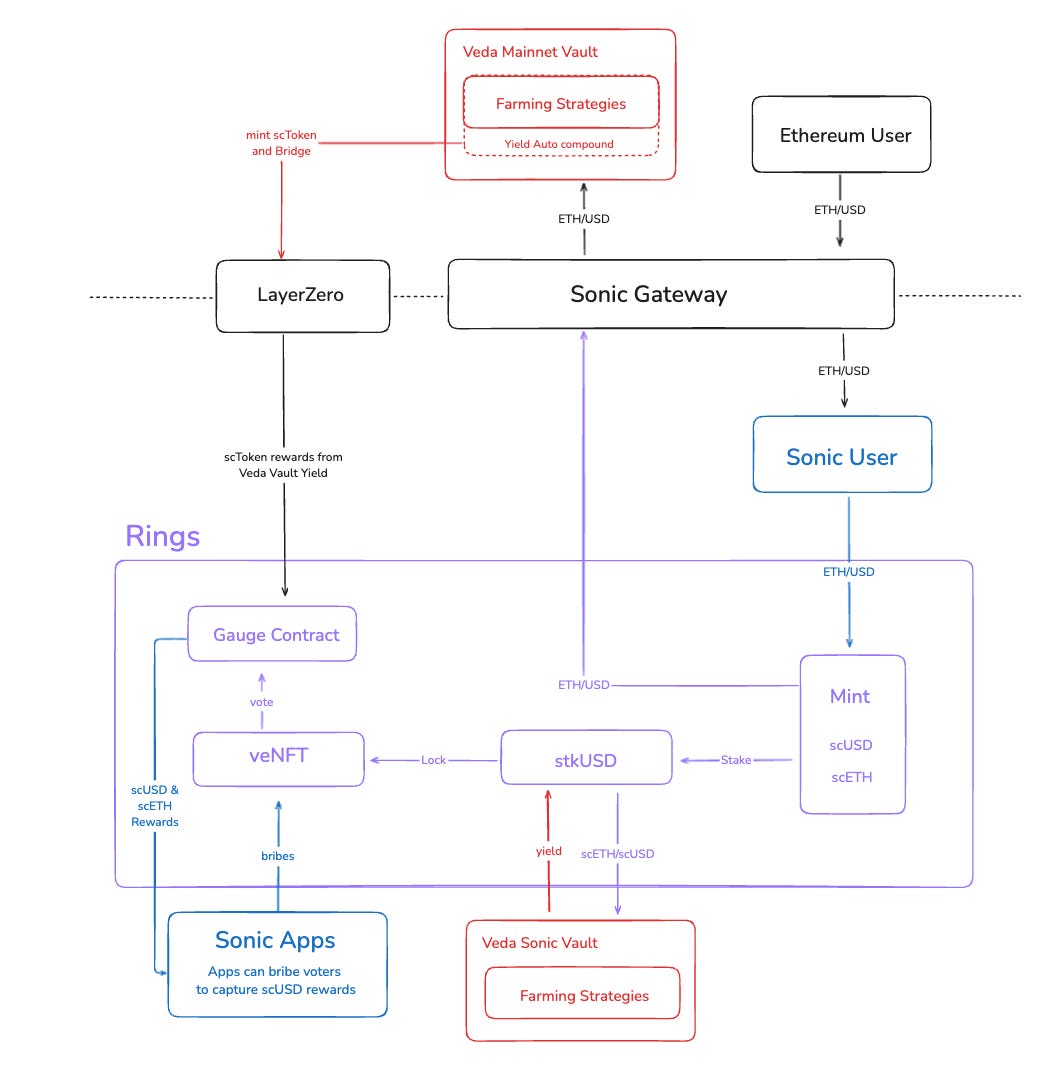

ETH and Stablecoin holders can deposit their assets on Rings directly from Ethereum mainnet, which are then being bridged via the Sonic Gateway for fast and secure transfer to the Sonic network, where the ETH and stablecoin deposited will be used to mint scETH or scUSD token at a 1:1 ratio.

When minting scUSD and scETH tokens on Sonic, Rings protocol automatically sends the underlying ETH and Stablecoins to a Veda boring vault (on Ethereum mainnet) where it will be put to work in farming strategies using protocols like AAVE, Convex, Morpho, and assets like crvUSD, sDAI and more. The yield generated by these farming strategies is continuously auto compounded within the Veda vault to increase APY, and once per epoch all the yield generated by the mainnet Veda vault is swapped in ETH and stablecoins to mint new scUSD and scETH that will be sent to Rings veNFT gauge system and distributed among Sonic dapps based on the gauge vote results every epoch.

Rings users can stake their scUSD or scETH to activate the native yield bearing properties of the assets, when staked the scUSD and scETH are sent to a Veda boring vault (on Sonic this time), automating farming strategies, rebalancing assets, and redistributing yield to stakers.

Staked scUSD or scETH can further be locked to activate economic governance rights, inspired by the Solidly veNFT model pioneered by Fantom builders, and bringing in two game changer components:

1. The locked token is not another native governance token with no value outside of the protocol but real valuable ETH and stablecoin wrappers, making the stakes behind Rings governance the most valuable of the space ;

2. The incentives distributed by rings, in addition to be also denominated in ETH and stablecoin wrappers (thus much more valuable again than traditional liquidity mining), are not distributed within the protocol itself but to every other Sonic apps who gets whitelisted on Rings, hence effectively bootstrapping the whole ecosystem based on a stablecoin and ETH yield flywheel.

Sonic dAPPs can attract veNFTs votes toward their project gauge and thus increase their scUSD and scETH rewards allocations by taking part in vote incentives market (or bribe market) directly through Rings integration of Paladin Quest, the most advanced voting incentive protocol available on-chain.

Rings yield projection metrics

At the heart of Rings farming opportunities are two main APR sources, direct liquid rewards accrued through the Veda Boring vault farming strategies, and indirect airdrop farming of Sonic native $S token through the GEMs & Point program.

GEMs:

Note that GEMs count is independent of Points count in the $S airdrop calculations. Around 40% of the $S supply share dedicated to the airdrop will be distributed to GEMs farmers, while the remaining 60% of the airdrop will be distributed to Points farmers. GEMs can only be farmed via Sonic Boom grant program recipient projects (including Rings, in the proportions described by the above image). Points can also be farmed via Rings, like via any other protocol on Sonic.

Sonic Boom builder grant: In addition to the GEMs earned by Rings users as a core ecosystem dAPP as part of the Sonic $S airdrop program, Rings users will also share an exclusive GEMs allocation as part of the Sonic Boom builder grant program. These extra GEMs will be distributed proportionally to Rings’ own point system based on the following calculations:

1 point / scUSD / day;

2x if staked;

3x if locked;

3.5x if locked in the Tholgar pounder;

Rings Points will be distributed over 25 cycles of a week each. This means that each cycle will allocate 4% of all GEMs earned by Rings.

Bribe Market:

The Rings vote incentive market capacity is capped by the yield generated by assets staked in the Veda Boring Vault, redistributed to Sonic apps through the veUSD governance system of Rings. Hence, assuming different levels of TVL -corresponding to total value of USD & ETH wrapped to scToken-, and a market yield benchmark of 18%, we can draw the following projections.

Reminder that veUSD governance markets will be exclusively operated by Paladin Quest, thus generate revenue to be redistributed through the $PAL token revenue sharing tokenomic.

Ecosystem connections (Veda, Beethoven, …)

Rings is developed in collaboration with Veda, Mithras Labs by the builders of Paladin, and Tholgar to form an alliance of experts in liquidity management and incentive structures and build the ultimate meta-stability primitive as a core Sonic product.

The Boring Vault farming strategies open doors for partnerships with established blue chip DeFi projects like AAVE, Curve, …, and many more to funnel ecosystem level liquidity toward their dAPPs.

The veNFT governance model engages every dAPP on Sonic by reflecting ETH and stablecoins holders interests for each of them to accurately distribute rewards across the ecosystem, effectively positioning Rings as the keystone of hype and economic efficiency on Sonic.

While Rings will not have its own native token, the contributors' flagship projects represent beta plays to Rings’ growth and prominent role within Sonic ecosystem. Paladin will benefit by network effect through Quest for Rings veGovernance and Veda through the Boring Vault TVL.