Weekly Gauge #8: Lock Rate Turnover

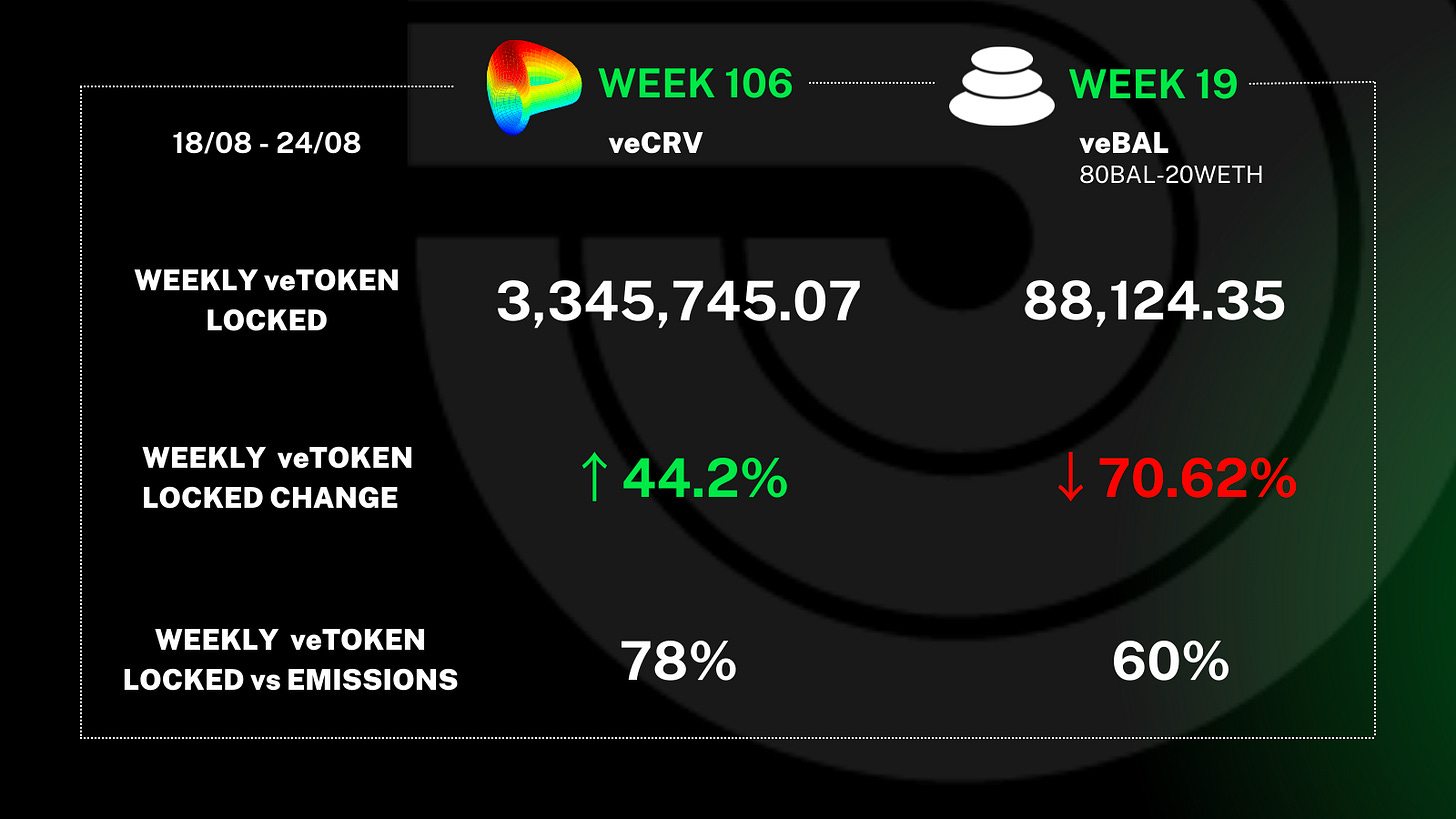

Curve Week 106

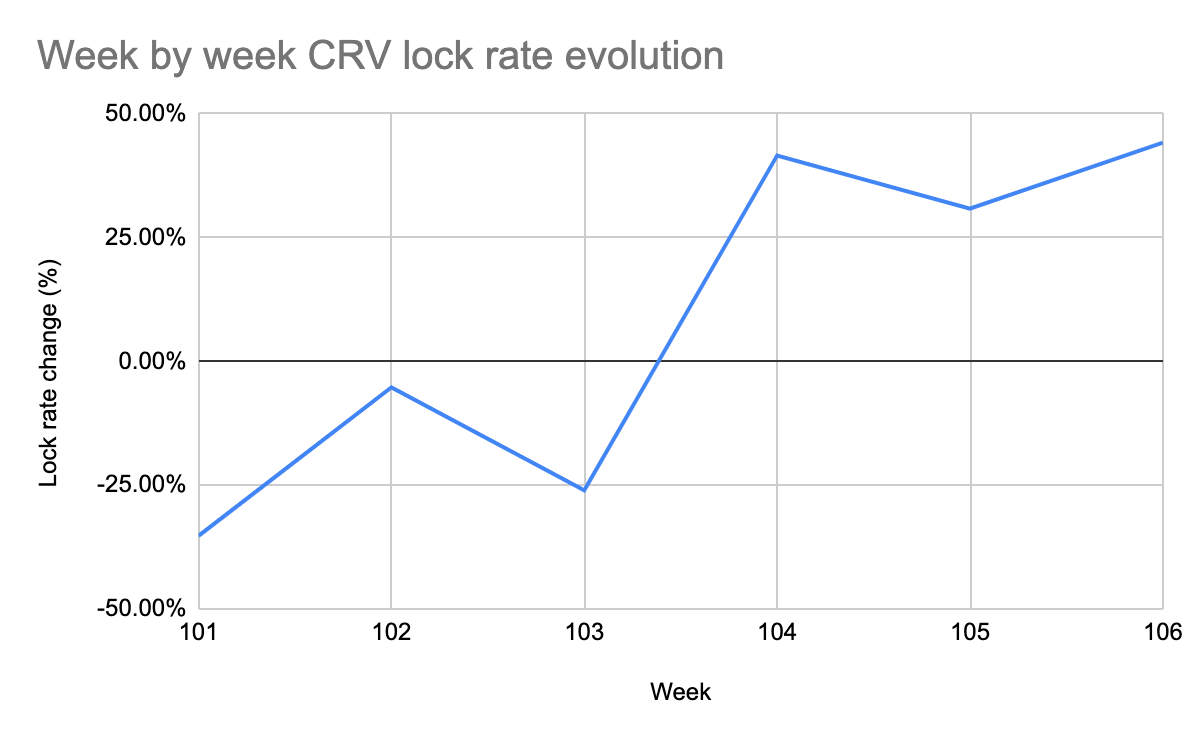

A few weeks ago, we formulated several hypotheses regarding the market reaction to the CRV yearly emission drop. It's been three weeks since it occurred, so we can already draw some observations from the current market trends :

The price of CRV token hasn’t spiked yet, probably due to a slight correction on the major currencies (ETH and BTC)

The long-term holders seem to stick to their convictions as the CRV lock rate has been increasing for the three first consecutive weeks of the new emissions.

The price action of the bribes market hasn’t reacted to the emissions drop yet, but various projects are starting to explore new frameworks to make their budget more capital efficient (i.e Lido’s update on reWARDS V2 and Balancer’s gauge Framework v1).

Note: vlCVX holders currently control 54% of the total veCRV supply and the CRV lock rate is 60% of daily circulation inflow. This shows that the majority of Curve stakeholders are still satisfied and confident with the yield generated by the protocol.

The CRV reward dropped by 15,9%, from 633k daily CRV emissions to 532k, while voting incentives remained flat. On the other hand, if we consider the TWAP of CRV for each round, the total value of bribes incentives is still inferior to the overall $ emission of CRV. However, this doesn’t mean that all protocols generate net profit from their incentive campaigns.

We can observe that most bribes are directed toward the Convex layer while organic veCRV holders are essentially fed by Curve and Convex themselves. Here are several take-aways from this observation:

Most organic veCRV holders are projects willing to own governance power in order to self-direct the CRV emission to their pool and POL;

Many veCRV have been locked before the launch of Convex and they are now seeking yield opportunities instead of liquid lockers.

Paladin’s products (Warden and Quest) have been historically oriented toward those organic veCRV holders. The data shows that they are also perfect tools for projects owning governance token and willing to put them to work while avoiding too much risk tranches on their treasury assets.

Note: Quest has recently added compatibility for vlAURA for its Balancer marketplace, so you can expect something similar to happen for the Curve ecosystem in the near future.

Balancer Week 19

A few days ago, Balancer introduced their Gauge Framework V1 on their governance forum. This post follows up on the recently highlighted inefficiencies encountered on Cream and GraviAura gauges. These have been killed because they attracted too much emissions versus the revenue they yielded to the protocol. The veBAL (and vlAURA) distribution is part of the answer to the issue:

The second and fourth biggest veBAL holders wallet are Badger and Cream, respectively, whales abusing the emission system

This new framework aims to deliver simple and objective rating criteria that the Balancer community can use to filter all current and future gauges. It relies on two main criteria which are related to the weight of a pool (TVL) and revenues created by those pools. While the discussions have been deep and complex, it is highly likely the framework eventually sees the light of the day.