Stability on-chain

Stability is a fundamental primitive that encompasses several dimensions:

Price stability in decentralized assets can be achieved through various mechanisms:

Collateralization (over-collateralization being the most common)

Algorithmic stabilization and AMMs design

The concept of "deep liquidity" is crucial for maintaining stable markets, it will also rely on trading volume consistency and arbitrage efficiency.

On the other hand, System stability, which relies on:

Economic incentives alignment

Risk distribution across participants

Protocol governance

The key challenges identified in a correct economic environment are:

Oracle Dependency: Price feeds must be reliable and manipulation-resistant

Game Theory Implications: Participant behavior can create feedback loops ; Incentive misalignment can lead to systematic instability

Back in Bitcoin's early days, high volatility made it impractical for everyday transactions, as merchants couldn't price goods consistently and users faced significant currency risk between transactions.

From these trading requirements, cryptocurrency exchanges identified the need for a stable unit of account, as traders wanted to "park" profits without exiting to fiat, and cross-border traders needed a stable intermediate currency.

Without stability, many of the promised benefits of blockchain technology (programmable money, smart contracts, DeFi) would be limited in their practical application. This realization turned stablecoins from a nice-to-have feature into a necessary building block of the crypto economy.

Stablecoins Map

Existing Stablecoins can be split within 3 categories:

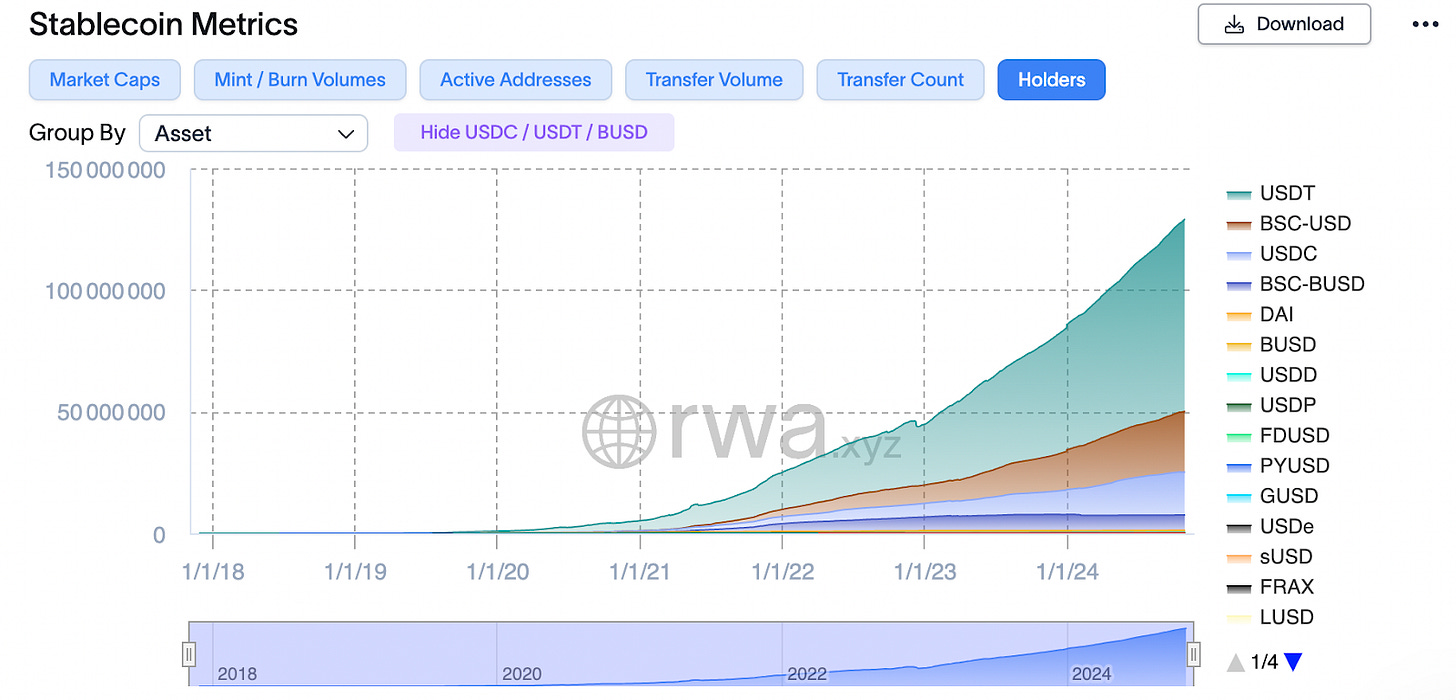

Fiat Backed (USDT ; USDC) is the most adopted by the retail due to its simplicity and hard stability. Although they are most prone to centralisation risk, custody risk, and regulatory dependence, they are easy to integrate for B2B and daily payments, thus can attract the largest holder base as highlighted in the following graphics of stablecoin dominance per unique holders addresses.

Crypto Backed (FRAX ; DAI ; Dyad ; crvUSD) are less efficient in their simplest form due to the over-collateralisation required, but can overcome it thank to yield bearing properties and other iterations aiming to minimize capital idleness. Most of these can be considered collateral debt position rather than actual currencies, which introduces liquidation mechanisms that ultimately limits their supply growth. Innovative designs reducing Loan to Value requirements or trailing liquidations can make it very competitive financial vehicles compared to traditional equivalents.

Algorithmic (RAI ; RICO) are often focus on disruptive solutions to the stablecoin problem. Unlike conventional stablecoins that aim to maintain a fixed peg, RICO envisioned a currency system where price stability emerges naturally through market forces and programmatic monetary policy, similar to how commodity money historically maintained its value. Heavily inspired by Nikolai’s work on RICO, Reflexer’s developed and ETH backed stablecoin called RAI, further exploring non-USD pegged design and automated monetary policies, reducing the role of governance in system stability hence the social bias. This is the introduction of floating currencies.

One common metric on which every stablecoin aims to improve is capital efficiency, from low institutional ROIs to high return promising airdrop campaigns, the adoption will always be driven by economic incentives, can it be in exogenous tokens to avoid inflation and sustainable to encourage holders stickiness.

Nonetheless, capital efficiency alone isn’t a golden path to adoption, generating native yield or allowing users to leverage specific DeFi products are features targeted at sophisticated on-chain traders. To ensure a holder will stick to a stablecoin it should be available on every DEXs or Chain and support native transfers without relying on wrappers or derivatives. While open source transparency is not a mandatory aspect -as most users will refer to a social consensus- it is important that trusted opinion leaders print an hold a “safety cushion” share of the supply.

Optimal set up

Complementary to its efficient and accessible design, the newly released stablecoin as much as the well established one, shall provide users and holders a complete environment to yield, trade, bridge, and spend the asset without friction.

From an on-chain perspective this can be achieved through a set of prerequisites that evolve in tandem and cannot do without each other:

Pairing accuracy to provide direct routes for exchanges and aggregators between protocols and chains. To bolster adoption of a stablecoin it should be easily tradable from any network and against any other asset type, this implies providing liquidity to multiple AMMs with a wide range of paired assets.

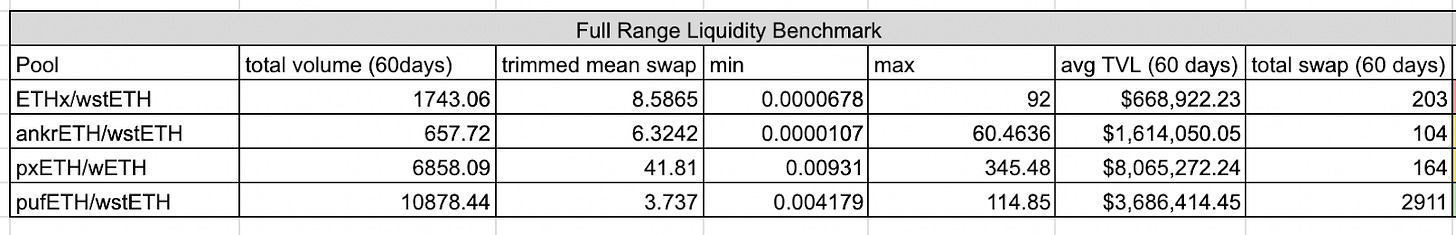

Liquidity depth and efficiency, harnessing concentrated liquidity and full range distributions to maximize liquidity utilization while ensuring minimum slippage. Using benchmarks of other similar assets’ pools helps identify flaws and strengths in the pools composition. Concentrated Liquidity is especially useful for Stablecoins since most of the trading volume will range within small ticks around the peg or target price in the case of float coin.

Incentives campaigns must be aligned with onboarding institutional holders and rewarding DEX liquidity as well as CEX liquidity. Revenue for the stablecoin issuers can come from rehypothecation of the deposited capital such as Tether is leveraging T-bills, or from partnerships like Circle does with Coinbase for 5% APR. Liquidity mining of a project’s utility token to reward stablecoin farmers should be self-sustainable hence integrate rebasing, burning, or buy back functions.

This exploration of stablecoin architecture reveals how stability has evolved from a simple market need into a sophisticated technological and economic challenge. From fiat-backed solutions prioritizing simplicity and adoption, to algorithmic designs pushing the boundaries of autonomous monetary systems, each approach offers unique tradeoffs between stability, decentralization, and efficiency.

The article highlighted that successful stablecoin implementation requires more than just technical soundness - it demands a holistic ecosystem approach encompassing liquidity depth, pairing accuracy, and carefully aligned incentives. These lessons about liquidity provision, market making efficiency, and incentive design are particularly relevant as we turn our attention to Ethereum derivatives in our next piece.