In DeFi, the capacity of a tokenomic to support a project’s economic growth is often determined by the users behavior and overall market sentiment, highlighting the importance of relying on incentives or friction points to coordinate stakeholders and retain capital.

In a decentralized ecosystem, beliefs are often a very social and irrational thing, as a result market driven mechanisms shall be carefully integrated in the strategic design of a protocol, leading to one essential question:

How to empower the market while protecting it against self fulfilling prophecies and negative feedback loops ?

Classic Economics

In economic theory, "market driven" generally refers to processes or decisions that are primarily influenced by market forces rather than by centralized planning or intervention. This concept is rooted in the ideas of classical economists like Adam Smith, who introduced the notion of the "invisible hand" in his seminal work "The Wealth of Nations" (1776).

Key aspects of market-driven systems include:

Price Mechanism: Prices are determined by the interaction of supply and demand, as described by Alfred Marshall in "Principles of Economics" (1890).

Resource Allocation: Resources are distributed based on market actions rather than central planning, an idea championed by Friedrich Hayek in "The Use of Knowledge in Society" (1945).

Consumer Sovereignty: The principle that consumer preferences ultimately drive production decisions, as discussed by William Harold Hutt in "Economists and the Public" (1936).

Creative Destruction: Joseph Schumpeter's concept from "Capitalism, Socialism and Democracy" (1942), describing how market forces lead to continuous innovation and economic restructuring.

In financial markets, "market driven" often refers to the Efficient Market Hypothesis (EMH), proposed by Eugene Fama in his 1970 paper "Efficient Capital Markets: A Review of Theory and Empirical Work". This theory suggests that asset prices reflect all available information, making it difficult to consistently outperform the market.

However, it's important to note that pure market-driven systems are theoretical constructs. In practice, most economies and markets operate with varying degrees of regulation and intervention, as recognized by economists like John Maynard Keynes in "The General Theory of Employment, Interest and Money" (1936).

Magic Internet Money

In DeFi, smart contracts can automatically perform actions, allocate resources, or adjust parameters based on predefined conditions. This can reduce human error and bias, allowing for more efficient and rational market operations. The programmable nature of tokens allows for the creation of "reactive tokenomics" that encourage or punish certain behaviors.

When releasing a token in crypto you essentially have 3 options:

Letting people do what they want:

This approach aligns with the classical Price Mechanism concept discussed in part 1.1. In a purely free market, token holders would be able to buy, sell, and use tokens without restrictions, allowing supply and demand to determine the token's value. However, in the crypto space, this would often lead to short-term profit-seeking behavior. The most technically educated market participants can use MEV or undisclosed insider information to manipulate prices. This unrestricted approach can result in a rapid extraction of value from the project, potentially "killing" it by draining liquidity and undermining long-term sustainability.

Creating algorithmic constraints:

This option acknowledges the limitations of the EMH in the crypto space. While blockchain technology provides unprecedented transparency, allowing all market participants to access the same information theoretically, the reality is more complex. Insider information, coordinated actions by large holders (cabals), and the rapid pace of developments often make it possible to outperform the market, contradicting the EMH. To counteract this, projects implement algorithmic constraints like token locks (preventing immediate selling) or slashing mechanisms (penalizing certain behaviors). These create friction in the market, potentially reducing efficiency but also protecting against manipulation and encouraging longer-term holding. However, these mechanisms can be complex and may deter some users, highlighting the trade-off between protection and usability.

Implementing market mechanisms that reward virtuous actions:

This approach draws from the concepts of Resource Allocation and Consumer Sovereignty discussed in parts 1.3 and 1.4. By creating market-driven incentives for behaviors that benefit the protocol, these mechanisms aim to align individual user actions with the project's long-term success. For example, Olympus' bonding mechanism incentivizes users to provide liquidity directly to the protocol treasury, ensuring more stable liquidity. The ve33 model in protocols like Solidly rewards users for locking their tokens and actively participating in governance, with rewards tied to the performance of their decisions. These mechanisms allow for a more nuanced form of "Consumer Sovereignty," where users' choices not only drive the protocol's direction but are also directly tied to their potential rewards. This creates a feedback loop where rational, protocol-aligned behavior is economically incentivized, potentially leading to more efficient resource allocation within the ecosystem.

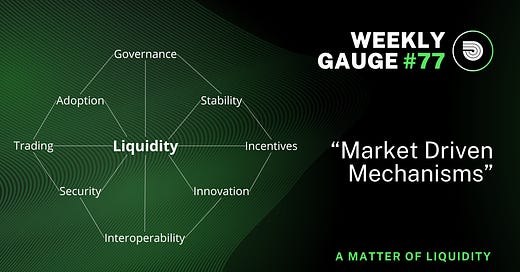

Liquidity, a core tokenomic component

Liquidity serves as the lifeblood of any token ecosystem, facilitating price discovery, enabling efficient trading, and supporting the overall sustainability of DeFi protocols often relying on token emissions. It's the foundation upon which all other tokenomic considerations are built. Without accurately allocated liquidity, even the most innovative and well-intentioned tokenomic designs can falter.

Assessing optimal liquidity levels can be done through a wide scope of analysis from simple pool utilization ratios to more tailored metrics based on the asset class and utility. At Mythras Labs, the historical company expertise on governance markets and incentives design is a strong foundation for a natural evolution toward liquidity management services.

Leveraging open source tools such as Dune Analytics, but most importantly a homemade database fed with pools, gauges, and DEXs data since Paladin inception, the accuracy of benchmarks and recommendations extracted from it represent a formidable resource to promote efficiency in DeFi tokenomics.

Throughout our exploration of market-driven mechanisms in DeFi, from classical economic principles to the intricacies of programmable money and governance tokens, one fundamental element emerges as the linchpin of successful tokenomics: liquidity. This observation will form the basis of an extended research article series that we will be exploring in the coming weeks. Our upcoming articles will delve deeper into various aspects of liquidity in DeFi, showcasing the work made by Mithras Labs, through Paladin on liquidity management.