In the initial version of Paladin, the PAL token worked exclusively as a governance token. It provided holders with voting power to influence critical decisions, including managing protocol parameters, allocating treasury funds, and initiating partnership programs. Despite its primarily political role, PAL holders were rewarded for their participation with additional PAL emissions. Consequently, 2/3 of the total supply was allocated to the community treasury which will now be used to support the tokenomics v2 upgrade.

Now that Quest has successfully achieved Product-Market Fit, with v2 emerging as the leading technical solution, integrating Quest with PAL tokenomics will enable Paladin to become a market leader in voting incentives while driving significant interest in the PAL token.

This article describes how Paladin became the most advanced and efficient addition to the DeFi governance stack since the release of Convex in April 2021.

Approaching the tokenomic release

Historical data

The buy/sell ratio on PAL token is more and more bullish with a reducing selling pressure seemingly marking a bottom whereas the buy pressure increases or maintains flat at the approach of new tokenomics release, similar to when it was initially discussed in the governance forum in late 2023. It is clear that the sentiment turned bullish on the token which could result in great reactions to the majors (ETH, BTC) moves that are also clearly on the uptrend.

Before the tokenomic launch, ≃3M PAL are already locked, which corresponds to 20% of the circulating supply.

b. What makes Quest v2 a leading vote incentive marketplace

Thanks to its presence on all major ecosystems leveraging governance markets, along with its multiple levels of customization, Quest v2 offers the smoothest user experience to bribers who are striving for efficiency and seeking to optimize their native liquidity distribution on-chain.

The fixed and ranged rates features allow control of the $/vote volatility, and sub options like roll-over to liquidity mining ensures a vote buyer their whole order will be filled without ever going sub 1x efficiency rate.

Beside the technical aspects, Paladin team provides regular, tailored analytics and recommendations to Quest creators, further confirming its expertise and sharing it with the ecosystem stakeholders.

How is tokenomic v2 shifting a gear up

How Bullish for the vote incentive creators

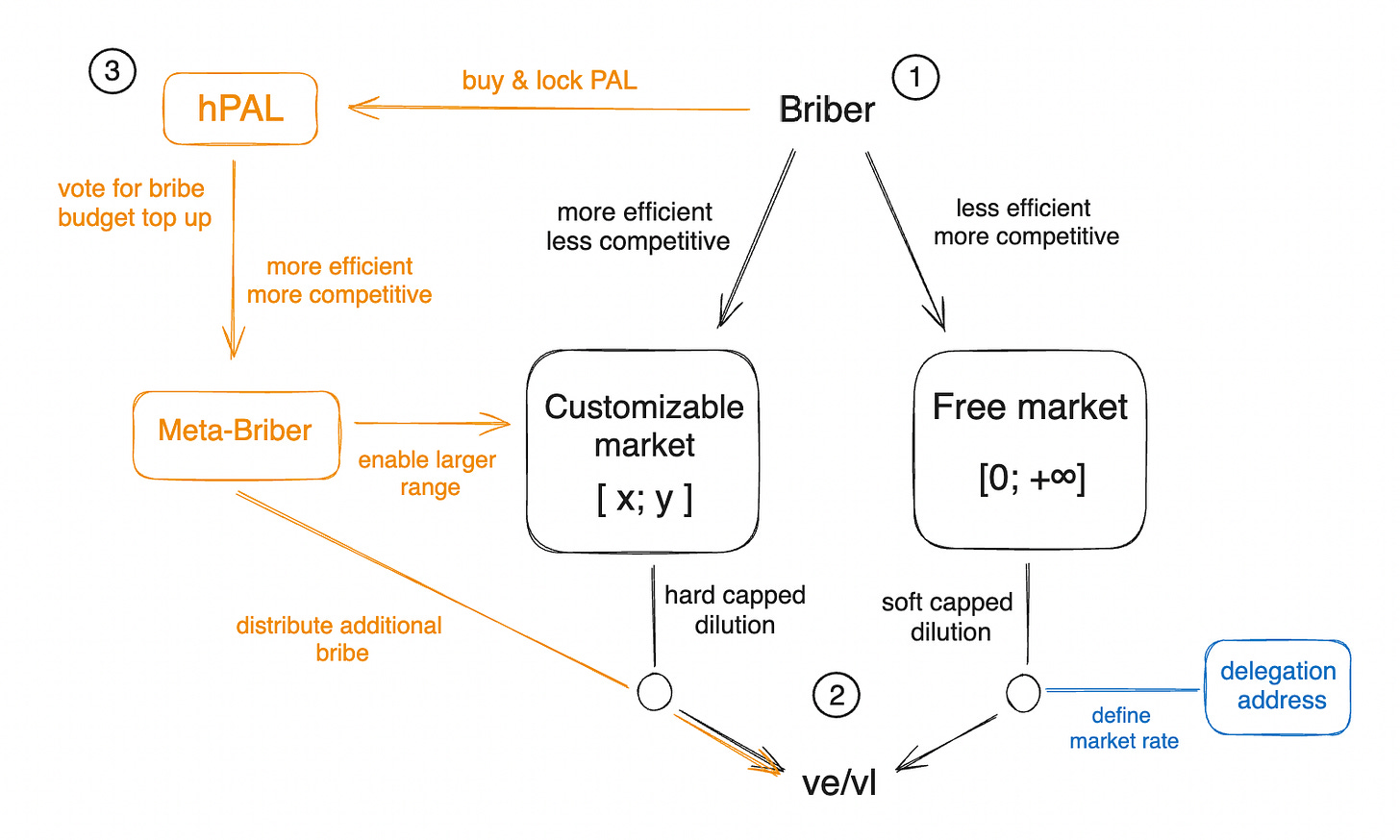

Let’s describe the advantages following the order steps 1, 2, and 3:

a.1) In the current state of vote markets, the incentive creator needs to first decide whether they will be going for:

a free market incentive (where the $/vote range is theoretically infinite, starting at the total value of the incentive and tending toward zero) that is likely to be more competitive at start but also proportionally less efficient in terms of $ of emissions accrued per $ spent on incentive.

or a customizable market (where the $/vote range is predefined between two specific values considered optimal) that is likely to be more efficient thanks to the lower volatility potential and predictable performance but also less competitive at start by never displaying insane profit potential for the voter and from the creator perspective because the vote accrual capacity is limited by the range minimum $/vote (aka range max votes)

a.2) Once incentives are live on both market types, it’s time for voters to decide which they consider most attractive according to several factors:

The customizable vote incentive will offer a hard capped APR dilutive potential, limited to the range low bound (min $/vote) that corresponds to the maximum votes accepted by this incentive. This is like the insurance of a minimum APR for the voter.

The free market vote incentive won’t offer predictable APR and will ultimately be much more volatile, but its dilution is soft capped by the intervention of delegation addresses, arbitraging the final market rate toward a common $/vote value based on total incentivized votes and total incentive volume ($$).

a.3) How does hPAL tokenomic provide a game changing advantage to customizable markets for incentive creators ?

To summarize the forces at play in points 1 and 2, from the briber perspective, it is more efficient but less competitive to incentivize through customizable markets and inversely less efficient but more competitive to go for free markets. The $/vote dilution hard cap of customizable incentives limits the maximum votes it can acquire although it ensures each of them a fair value, strengthening the market’s game theory.

Paladin’s new hPAL tokenomic is designed to fix the gaps in competitiveness of the customizable markets, making it more efficient AND competitive, especially for the users of the protocol flagship product “Quest”, while encouraging incentive creators (mostly 7-8 figures accounts aka whales) to buy, lock and compound Paladin’s native governance token $PAL

By becoming hPAL governors, bribe creators are able to direct PAL native emissions to top up their vote incentives on every DEX ecosystem, allowing them to set up larger ranges with higher maximum votes target and lower minimum $/vote values, while not affecting their initial incentive budget since the PAL emission top up will cover this part of the equation.

How Bullish for the Gauge voters

The other way around, the same mechanisms encourage ve/vl voters whose votes are sticky to specific gauges, to buy lock and compound PAL and direct its emissions toward the vote incentives of gauges they are sticky to.

From the voter perspective, it is safer and requires less active management to vote into customized incentives, and thanks to hPAL voters can add an extra layer of rewards to ensure better APR than they would expect from the free market.

hPAL Impact on Voter APR, thUSD + 3CRV Quest case study.

Now that we have seen all the theoretical benefits of the Vote Flywheel, let’s put it to test with an example from last round for the thUSD + 3CRV Quest.

This Quest aimed to attract 1,332,960 votes by offering rewards ranging from 0.05 to 0.056 T per veCRV vote. With these figures, it represents a $2,380 weekly incentive for voters.

In this case study, we will examine the incentive to hold hPAL from both sides of the vote and how it could significantly improve market efficiency.

In the table above, the thUSD +3CRV gauge has just received 10k PAL to distribute. Here’s how to interpret the figures:

First row: Represents the existing incentive structure.

Second row: Represents the base incentive in PAL to be shared among all voters.

rows 3 to 7: Show five voters participating in the Quest, each with an equal number of votes and an equal share of the base rewards. However, each voter has a different hPAL balance, illustrating how hPAL can alter the reward distribution.

Last row: Illustrates the scenario where only one voter with an hPAL balance votes in the gauge.

Let’s delve deeper into the numbers. This table aims to highlight how a voter’s APR changes based on their hPAL balance and the behavior of other voters in that Quest.

Initial Reward Boost: Even without any hPAL, voters receive a 3% increase in their rewards. This initial boost allows them to start accumulating PAL, providing a solid entry point.

Significant APR Increase: The APR can increase by up to 65% if a voter is the only one with hPAL voting for that gauge. This significant change is beneficial for both the voter and the Quest creator.

Such advantageous rewards create a strong incentive for voters to keep their votes within the gauge, as there is no equivalent market opportunity that offers similar returns. This stickiness of votes benefits everyone involved as voters receive higher returns on their votes and quest creators attract more votes for the same incentive budget.

Bullposting

How to snowball and unlock wETH revenue sharing potential

Over the past 4 months Quest V2 has maintained an average $105,000 volume per week, which represents only a tenth of the TAM on Curve and Balancer ecosystems.

With the release of Paladin new tokenomic, the quest volume each round is expected to 3x quickly by attracting many new and already active incentive creators.

At the current volume, Quest fees are covering around 30% of Paladin operational costs while in parallel warlord/warden fees and farming rewards from the project treasury and PoL covers the remaining 70%. With a 3x in volume the project’s flagship product would cover alone all the project’s costs, enabling the start of revenue sharing to hPAL holders from the other revenue sources.

That’s how you make à <$2M cap project go >$50M in a semester from now, and guess what ? That would also increase the value of emissions controlled per hPAL annually from $0.12 to a whooping $3 !

b. What’s next on Paladin roadmap

The numerous protocol upgrades overtime, along with an already existing leader position on the customizable incentive market and a long track record of partnerships forging a strong network effect, are many factors demonstrating Paladin commitment to deliver the most accomplished product.

Stay tuned for some Maverick related news in the coming weeks !