After the storm passes, we will be able to appreciate the rainbow in the sky and remember that every cloud has a silver lining. Aura’s recent price action has shown very little strength and, unlike Balancer, isn’t supported by the continuous compound of emissions, however things are about to change and yesterday’s $350k market buy of the token is a clear signal of the renewed interest in the project’s tokenomic.

The initial role of emissions was to bootstrap TVL and Aura’s veBAL share, resulting in Aura acquiring over 36% of veBAL supply, 44% of @Balancer’s TVL and capturing consistently over 60% of all BAL emissions.

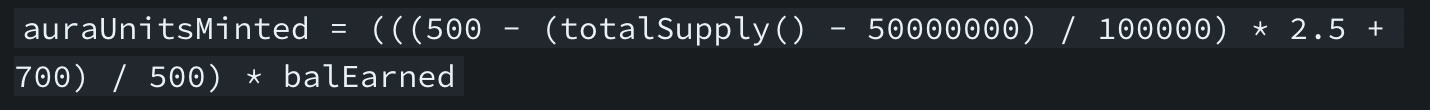

So far, Aura’s emission rate was ruled by a formula inspired from Convex one, starting at 3.9 AURA emitted per BAL captured after fees; trending towards 1.4 AURA per BAL as supply increases. However, because the cliff calculation set as a catalyst for the emission drop is handled differently in Aura’s formula, the rate decrease happened to be slower than expected, still sitting at 3.2 at the time when AIP-42 was proposed.

In order to lower the inflation rate and take advantage of the large amount of unvested tokens sitting in the treasury, Aura core contributors posted the AIP-42 on the governance forum late July and quickly passed it through the voting process to be implemented starting from August 17th.

Various projects deploying liquidity on Aura expressed their enthusiasm in comments of the Twitter announcement thread. In order to understand why, let’s take a deep dive into the analysis of the proposal outcomes.

Problema identified:

The original system allows Balancer stakeholders that are not aligned with Aura DAO to acquire large amounts of AURA, without providing direct value to the protocol.

Proposal details :

Reduce the AURA minted per BAL earned for all pools, resulting in a significant decrease in new AURA float. Set the RewardMultiplier on all pools to 0.4, meaning a 60.0% reduction in baseline AURA minted.

Compensate this reduction in emissions by using AURA allocated to the treasury and directing it to pools pro-rata based on their share of vlAURA gauge weight each voting cycle. Allocate 180,000 AURA from the DAO treasury bi-weekly.

Reduce AURA/ETH voting incentives, as per AIP-26, from 40,000 AURA in incentives per epoch to 30,000 to factor in increased yield from the above two changes. Keep extra tokens in the treasury to feed future emissions.

Goals :

Optimize AURA distribution in order to entice users to increase vlAURA accumulation and spend on voting incentives, increasing participation in the Aura DAO and the governance utility of AURA itself.

Bootstrapping L2 gauges faster by reducing the lag between a gauge going live and getting vote weight on L2s and reaching a steady-state of expected yield, and increasing voting incentive capacity for vlAURA, enabling further onboarding of pools of prominent assets and fulfill the increasing demand on L2s.

Foreseeable outcomes :

veBAL intrinsic value is losing a strong catalyst, resulting in a huge drop in emissions directed through this layer of vote. For comparison, when farming on Aura, here are the updated efficiency of voting incentives by layer based on last round $/vote ratio:

A shift of veBAL holder to vlAura might have several impacts and naturally arbitrage itself due to the correlations between all assets participating to the flywheel. If vlAura supply increases but auraBAL stays flat then veBAL controlled per vlAura decreases and so will voting incentives APRs. Nevertheless, if the increase in vlAura supply is proportional to the decrease in veBAL supply, with auraBAL remaining flat, the shift in governance power won’t affect the balance of value extracted per vlAura.

Effective outcomes after 1 round :

For incentive creators: Since the majority of veBAL incentives are concluded through OTC deals, we can’t help but assume parameters revised around 0.06$/veBAL to ensure a break even scenario for buyers. On the other hand, vlAura markets haven't shown a clear reaction yet as volume and cost of votes changed by less than 10%. Total effective voting supply on incentivized gauges is still on the uptrend without going exponential, and the % of incentivized vote remained equivalent.

Side Notes :

By aligning market participants on its own layer of governance rather than the original DEX’s layer, does this move kind of prepare the field for Aura to onboard a new ve ecosystem, by capping and decorrelating emissions from the underlying projects.

Changing the current 80/20 AURA/wETH pool for a 50/50 format would unlock a good stack of AURA to be used for treasury emissions, it could also encourage LP farming AURA emissions to migrate toward single staking solutions, the only one available currently being auraBAL staking which further encourage auraBAL growth.

The quick approval and implementation of the new tokenomic has a negative effect on several ecosystem participants owning large sizes of BPT tokens and willing to harness Aura emissions, due to low available on-chain liquidity for swapping as well as imbalancing outcomes on $/vlAura ratio relative to increase in incentive volume and auraBAL unchanged dominance.

In conclusion, AIP-42 represents a strategic move for Aura's growth and efficiency. By adjusting emission rates and directing treasury allocations, the proposal aligns incentives with the core participants, enhancing governance dynamics. The transition from veBAL to vlAura carries potential impacts on voting power and value distribution, contingent on the interplay of token supplies.

Furthermore, the proposal's proactive approach to ecosystem expansion and the emphasis on Aura's governance layer position the protocol for future scalability.