The primary goal of token emissions for a decentralized exchange is to bootstrap liquidity depth by encouraging users to contribute their tokens to liquidity pools; allowing the protocol to ensure that there is a smooth efficiency for trading and other activities on the platform.

When offering an enhanced yield to users with additional native token emissions, it is crucial for the protocol’s sustainability to create a utility that flywheels the token emissions into more value creation. By actively involving token holders in the protocol's operations, it encourages participation and strengthens the network effect.

However, if the market perceives the emission strategy as inflationary or lacking a clear rationale, it may undermine investor confidence and negatively impact the project's reputation. Moreover, insufficient revenue generation or inability to support emission rate with a solid economic model can threaten the project's sustainability over time.

Through this article, we seek to analyze why protocols employ liquidity mining to attract TVL, and formulate informed assumptions regarding the efficiency of properly distributed native emissions when they reach maturity.

To provide a bit more context on the motivations that led to the wide adoption of liquidity mining, let’s start by reviewing the basic sources for a protocol to generate and redistribute revenues.

Fees generation (direct value creation) : harness volume

By charging fees on their products or services, projects can generate a stream of income that can be considered as a form of yield when redistributed to a specific category of users. This yield is "real" in the sense that it represents actual revenue generated by the protocol's operations. It is not dependent on speculative price appreciation and is driven by the actual usage and activity taking place on the protocol.

Source : https://dune.com/queries/2689251/4472354

Composability (ecosystem value creation) : harness yield bearing components of platform’s TVL

Yield-bearing assets can be stacked or pooled together within a protocol, enabling users to compound their returns. By combining different assets with yield-generating capabilities, users can earn multiple streams of income or generate higher yields than they would by holding individual assets separately.

Composability fosters network effects and community growth within the DeFi ecosystem. When protocols can seamlessly interact and leverage each other's capabilities, it creates a mutually beneficial environment where the success of one protocol can positively impact others.

To incentivize voters to prioritize pools that generate significant revenue, Balancer has created the core pool program, redistributing swap fees in the form of voting incentives and leaning into a second revenue stream that can become the bulk of Balancer’s earnings. Additionally, boosted pools are an amazing mechanism to allow nearly any token with an associated lending market to become yield bearing.

Nevertheless, to remain competitive in a fast growing environment and strengthen the positive flywheel of attracting more TVL to offer a better trading experience and further align stakeholders, decentralized exchanges started to incentivize users with native token emissions.

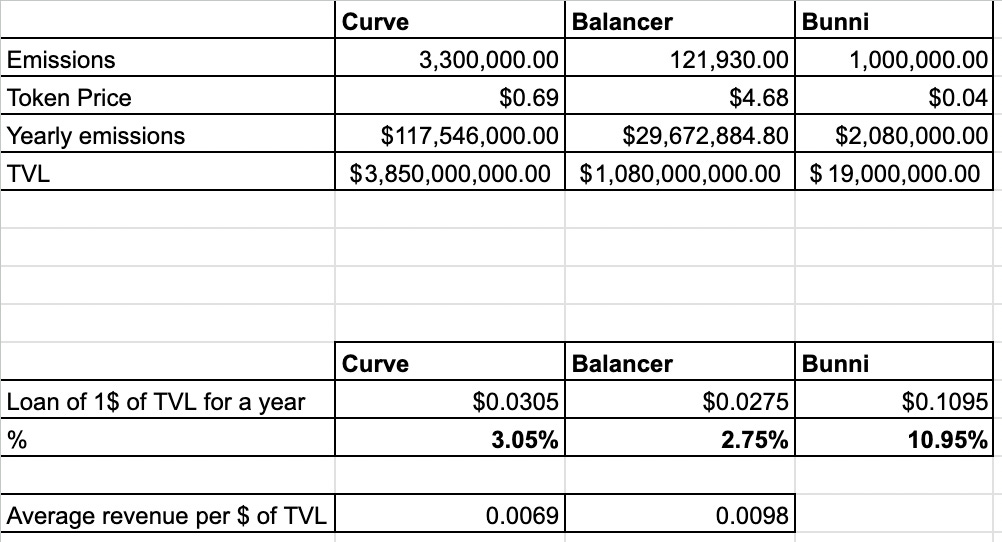

Amidst the multiple iterations from the original bonding curve design to the current most used voting escrow tokenomics, adding always more complexity and mechanisms to sustain the value of newly emitted token overtime, it is possible to quantify and compare models efficiencies by looking at the virtual price of DEXs’ TVL.

This table highlights the fact that voting escrowed tokenomic costs at maturity tends toward 0.03$ per $ of TVL, which for comparison shows around 3x more emissions’ efficiency than a 6 months old call option model. The discount offered when exercising the call option rewards might contribute to the gap in efficiency from the protocol’s perspective.

The ratio of token emissions to TVL should strike a balance that encourages participation without overwhelming the market or diluting the token's value excessively. On the other hand, if emissions are too low or hardly accessible, it may limit the incentive for users to participate, potentially stunting the growth of the protocol. This situation is highlighted by Timeless’ Bunni call options tokenomic, where costs of emissions are 3 to 4x higher than with a mature voting escrow tokenomic.

Moreover, by encouraging token locks, thus reducing the circulating supply, the existence of liquid lockers on top of a voting escrowed DEX tokenomic can further participate in aligning the interests of participants and support the emission process.

The importance of composability to offset costs is supported by the flattening of voting incentives market prices, although Convex and Aura Finance have similar emissions formulas with different levels of advancement, this demonstrate that the actual design maturity is that of the base layer, here Curve and Balancer.

Finally, it is interesting here to interpret sustainability as theorized by the lindy effect saying that the future life expectancy of a non-perishable thing, such as a technology or an idea, is proportional to its current age. The longer something has survived, the greater the probability that it will continue to survive. Except in this case emissions schedules eventually come to an end with all supply in circulation, which nonetheless doesn’t imply the end of the whole tokenomic.