In their relentless pursuit of decentralization, Arbitrum, an Ethereum Layer 2 launched its token $ARB and airdropped it to users and DAOs. During the past week over 87% of the airdrop has been claimed, and the Total Value Locked (TVL) on the network has experienced astonishing growth, reaching an all-time high and currently standing at 5.9B$ according to L2Beat.com.

Breaking its other metrics’ ATHs, 5 Arbitrum pools are currently sitting in the top 10 pools by volume, also orders of magnitude above all the market in terms of total transactions, resulting in Arbitrum greatly increasing its dominance over other L2s in terms of fees generated.

Arbitrum wars

To follow up on our introduction of multi-chain governance wars in Weekly Gauge #32 , we will analyze the recent launch of Arbitrum governance token which made the interactions on the L2 skyrocket totaling over 600M$ of bridged funds, and the potential outcomes on governance markets.

In order to bootstrap the development of existing projects on the L2, Arbitrum decided to follow the path of Optimism $OP grants by allocating around 150M$ of $ARB tokens to DAOs according to the size of their operations.

$ARB DAOs airdrop valuation at launch : 150M$ (one shot distribution event)

$OP DAOs grant program valuation at launch : 325M$ (distributed overtime)

Even considering the significant gap in value allocated by each network to bootstrap their DAOs ecosystem, it remains accurate given the context to compare with the impact on protocols using gauge tokenomics like Velodrome, to anticipate and identify farming opportunities on Arbitrum that could be subject to governance wars.

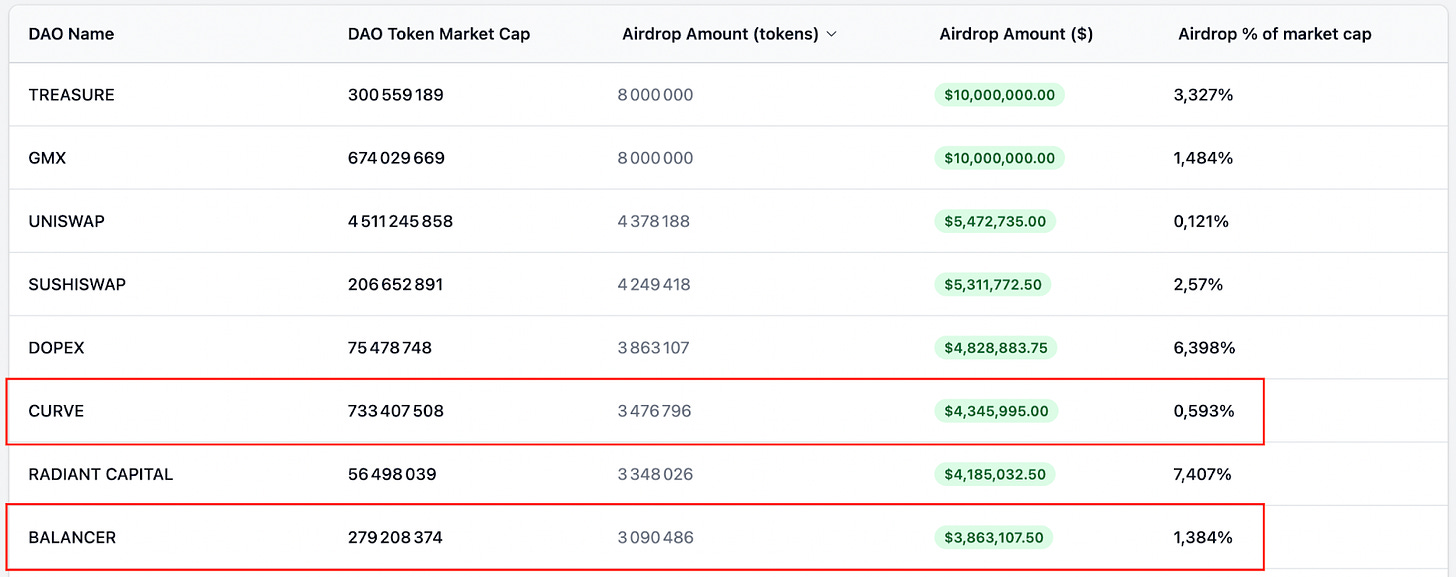

Source : ArbValues

First of all, our two protagonists Curve and Balancer have been airdropped a total of 6.5M $ARB but none of them disclosed any scheduled usage for it so far, holding tokens in their Arbitrum treasuries. It is important to note that Curve also benefited from the $OP airdrop but has yet to distribute it.

However, we can easily expect the airdropped token to flow toward veBAL or vote-locked wrappers holders, through incentives from projects like Radiant Capital with an apparent will to take over the TVL market share on Balancer Arbitrum, knowing that a Proposal is ongoing to create a RDNT-wETH gauge.

On top of that, projects like Excalibur that we’ve already introduced in Weekly Gauge #32 are also already taking advantage of the money printer and offer up to 4 figures APRs with a combination of incentives for voters and liquidity providers.

Last but not least, Aura Finance upcoming deployment on Arbitrum, Polygon and ZKsync will certainly be a catalyst for Ethereum staking derivatives liquidity on L2s, on which the Balancer/Aura ecosystem seem to have focused to counter Curve / Convex dominance on stablecoins pairs.

$ARB governance

The Arbitrum DAO is a new entity with decision-making authority over the Arbitrum One and Arbitrum Nova chains, along with their underlying protocols. The Arbitrum protocol allows each chain to have one or more "chain owners" who have the power to take administrative actions that change a chain's core protocol and code.

https://docs.arbitrum.foundation/dao-constitution

With the $ARB token generation event and subsequent creation of the ArbitrumDAO having occurred, "owner" privileges on both the Arbitrum One and Arbitrum Nova chains have been given to both the ArbitrumDAO and the Security Council of The Arbitrum Foundation.

Note that the Security Council is a committee of 12 members who are signers of a multi-sig wallet divided into a September Cohort of 6 members, and a March Cohort of 6 members. There will be a yearly turnover of every Council member.

The constitution of Arbitrum governance is far from the veTokenomics that we are used to cover on the Weekly Gauge, however, it is very much aligned with the Ethereum ethos and governance processes which seem to be a well-informed choice for the development of the network.