Weekly Gauge #29 : Ve-Boost: the governance chaos emeralds

Part-1 : setting the bases for a deeper analysis

Introduction :

The world of decentralized finance has grown with the rise of voting escrowed tokens, such as those used in protocols like Curve Finance, GMX, and Plutus DAO. These tokens not only serve as a way to govern the protocol but also come with a unique feature, the boosting mechanism. This mechanism rewards users for holding and using the tokens, and it can have a significant impact on the yield earned by users. Despite its importance, this feature is often overlooked and underappreciated. In this article, we will delve into the boosting mechanism of vote escrowed tokens, explore how it works and debate its potential impact on the yield earned by users.

Many projects have adopted boost mechanisms through different manners, think of them as the chaos emeralds of the crypto world, providing users with superpowers to increase their yield.

Case studies:

The boost mechanism in the Curve Finance protocol is a way for liquidity providers (LPs) to increase the returns on their liquidity provision by increasing the weight of their liquidity in the pools. The boost factor is determined by an equation that considers the LP's initial balance, the total locked CRV in the Voting Escrow contract, the weight of the LP's vote and the total weight of all votes.

The introduction of the Convex Finance protocol affects the game-theoretic perspective of an individual player in the sense that it gives them more options and flexibility in terms of how they can increase their returns on a Curve LP.

An interesting concept that can be used to analyze it is the Stackelberg game. In this type of game, one player, called the leader, takes their action first and the other players, called the followers, take their actions afterwards. In the case of liquidity provision in the Curve Finance and Convex Finance protocols, it can be argued that the liquidity providers who lock CRV in the Voting Escrow contract are the leaders, as they are the ones who are setting the boost multiplier for the other liquidity providers. The liquidity providers who do not lock CRV are the followers, as they are choosing their strategy based on the actions of the leaders. We will dive deeper into the mathematical explanations of this concept in next week's article.

Within the GMX project, the stakers of the protocol’s native token can earn something called Multiplier Points that help boost yield and reward long-term users, helping further decentralized ownership on the platform. The rewards are distributed in the form of escrowed GMX (esGMX) tokens, which can be staked to earn further rewards or vested. If a token holder vests these tokens, they are converted back to GMX tokens over 12 months. esGMX tokens act as a form of locked staking, preventing holders from selling their tokens immediately and staving off inflation.

The Plutus Boost is a new mechanism designed to reward lPLS lockers who use Plutus DAO's products. As a user's percentage of lPLS owned increases proportionally to their percentage of Total Value Locked (TVL) in a vault, they will achieve boosted rewards, with a maximum boost of 2.5x multiplier on their rewards. This means that lPLS lockers will be able to earn significantly more rewards than they do currently, while mercenary capital will be penalized. The mechanism ensures a level and fair playing ground for all users by requiring that larger players must proportionally own the same percentage of lPLS as their TVL.

Trading opportunities :

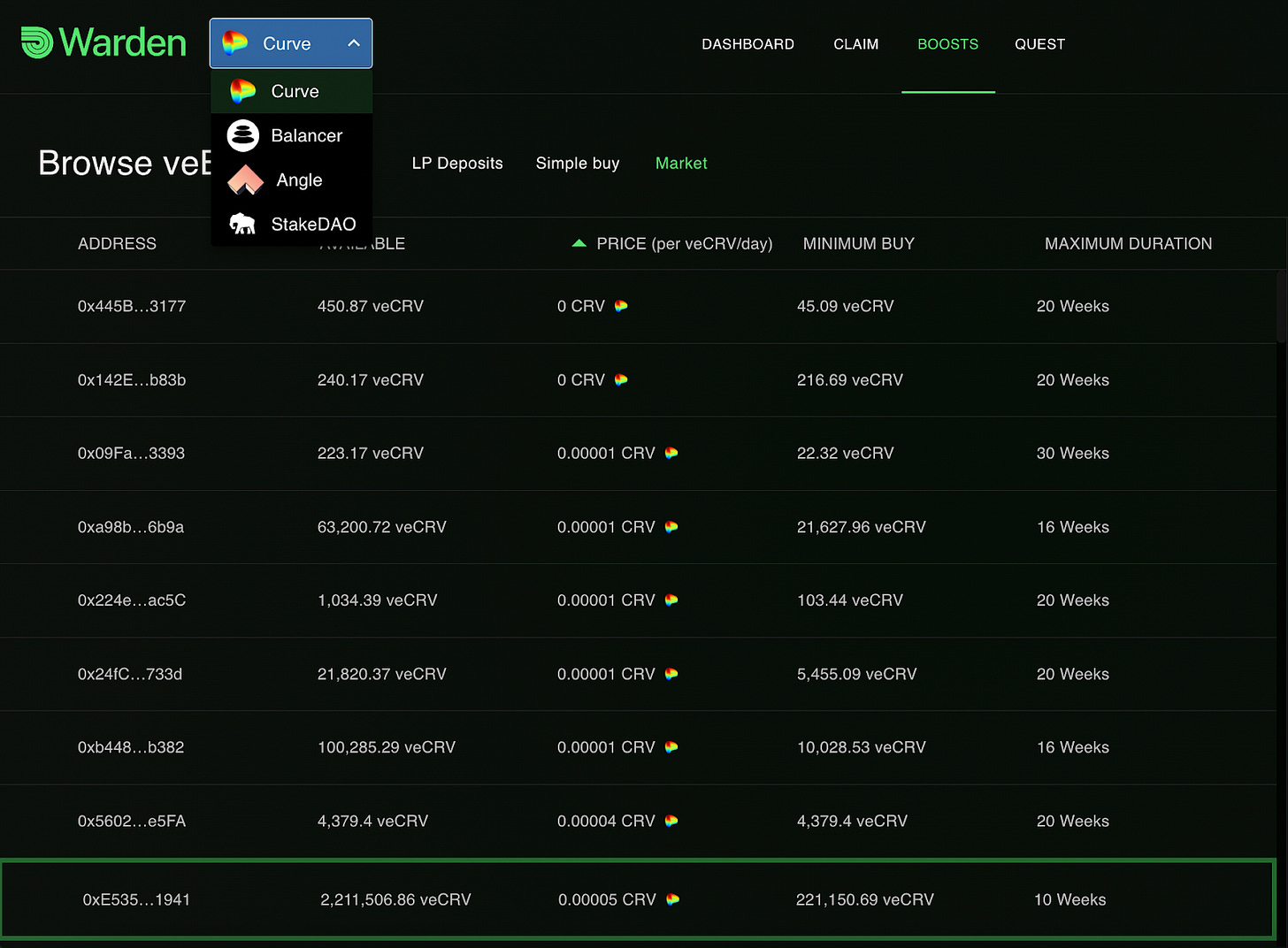

Arbitrage opportunities can arise in many different markets, and the boost power market is no exception. Arbitrage in this context would involve finding a situation where the boost power is being traded at a different price on different platforms or markets such as Paladin Warden, and then taking advantage of this difference to make a profit.

https://app.warden.vote/boosts/market/

One question a user should ask themselves is how to max boost their position for the lowest cost. Empirically the calculus made is the ratio between a gauge’s liquidity and a user’s ve holdings.

Referring to Curve/Convex case study we can assume that it will depend on the protocol’s control over a specific gauge where their holdings of over 50% of the veCRV supply helps maximize the boost multiplier.

Conclusion :

In conclusion, projects implementing boost mechanisms create a dynamic game between liquidity providers, where players must consider various factors such as the proportion of locked tokens to the total token supply, expected price movements, and their investment horizon in order to maximize their returns. In the Part-2 of this study, we will dig Game theory concepts such as the Nash equilibrium and the Stackelberg game to analyze the behavior of players and the outcomes of the game.

Reads to prepare for Part-2 :

Curve : https://curve.readthedocs.io/dao-gauges.html

GMX : https://blockgeeks.com/guides/what-is-gmx-protocol/

Plutus :

Stackelberg Game lecture : https://ppt-online.org/59871