The building in bear analogy is in full effect for this start of year, as numerous projects are launching themselves into new tokenomics. We thought it would be wise to highlight those who are adopting gauges. The biggest of them being Yearn.

Yearn Finance is a yield aggregator on Ethereum. The Yearn protocol utilizes a system of automated market makers (AMMs) and liquidity vaults to facilitate the provision of liquidity to other DeFi protocols. By providing liquidity to these protocols, users can earn returns in the form of interest or fees.

Yearn is a DeFi darling that has been considered a blue chip almost since its inception. This is however to be contrasted with its diminishing TVL, caused by both growing competition and a less favorable market.

Keenly aware of its trajectory, Yearn has iterated on multiple fronts, namely by going multi-chain, revamping its yCRV strategies, as well as its tokenomics, inspired from the veCRV.

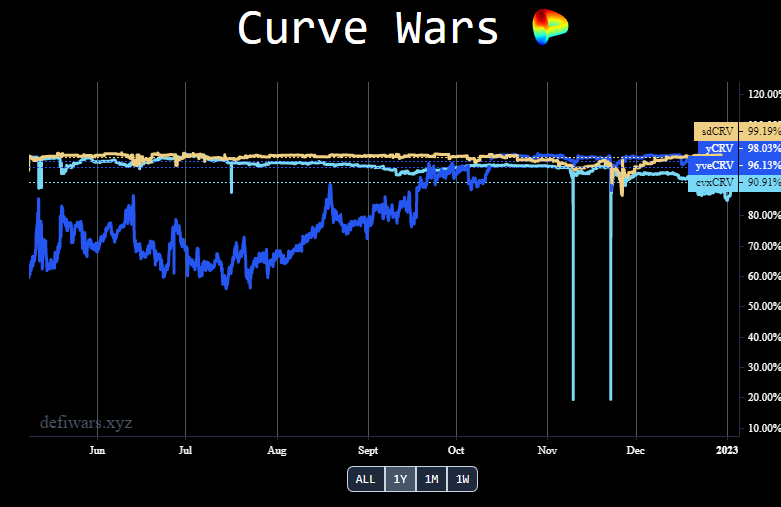

When initially released, Yearn’s yCRV was the sole CRV liquid locker but it was quickly overshadowed by Convex’s cvxCRV, and then Stake’s sdCRV. It was high time for a facelift.

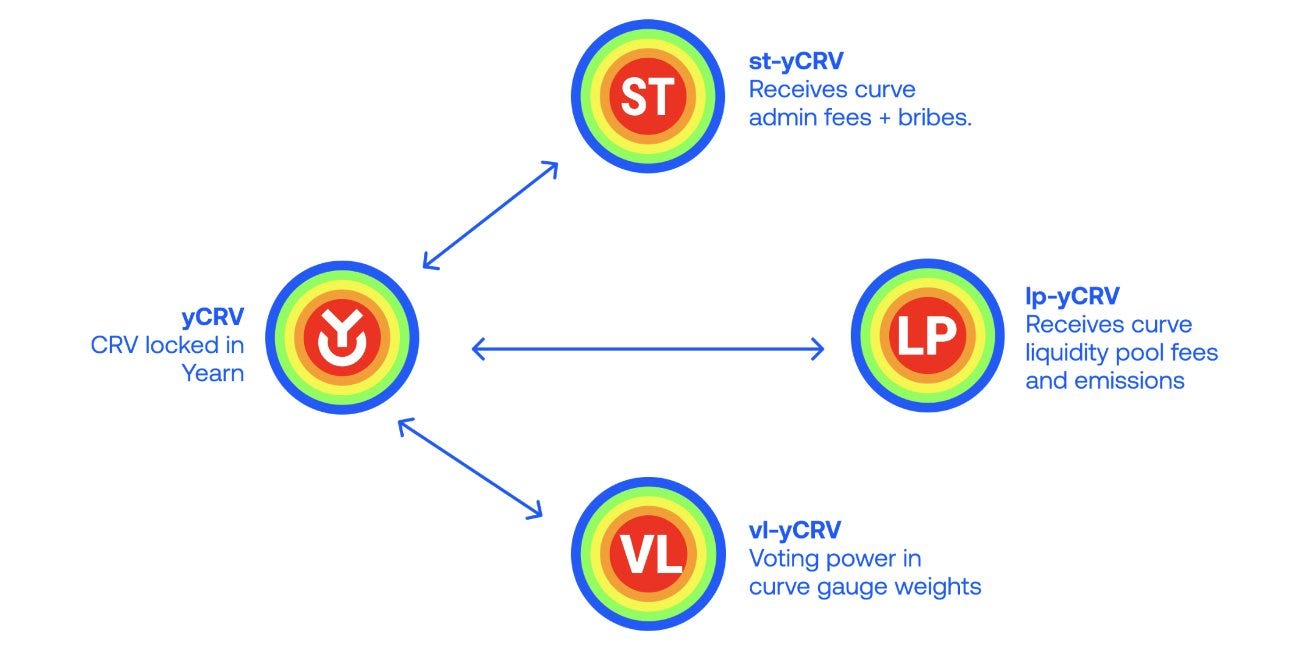

The new vault offers stakers 3 staking modes that benefit from different perks:

St-yCRV sits at 36.11% APR while lp-yCRV is at 42.28%. Please do take into consideration vl-yCRV is yet to be released.

The yCRV locker was released in fall and has proven to hold its peg extremely well despite market conditions as well as offer continuous competitive yield.

On the tokenomics side of things, the comparison shouldn’t stop at “veCRV like” since YFI is in a much different situation than CRV. Curve has an inflation model based on the emission of new CRV while YFI supply is already fully emitted. To provide a similar incentive than the veCRV to lock veYFI, Yearn is using accrued fees of the protocol to buy back YFI tokens on the open market and redistribute it through vaults gauges.

Additionally, it’s possible to exit the lock early, in exchange for paying a penalty that gets allocated to the other veYFI holders. This opportunity for participants to voluntarily realize a loss changes the game theory of the locking mechanism in favor of loyal veYFI holders and add a potential extra revenue stream. This means that conviction plays will be rewarded on the long run while less long term thinkers will have the opportunity to cut their losses.

This seems like a really strong system that should bolster Yearn’s success. If we had to be picky, our concern would mainly be centered around the budget set for veYFI emissions. This budget is highly dependant on fees. According to Token Terminal, Yearn has been consistently earning ~250,000$ a week. While significant, we worry such amounts will be insufficient compared to other successful veTokens. For reference Curve emits over 1.5M$ / week at current rate, and Balancer emits ~800,000$ / week.

This implies two things. First, it is likely Yearn’s new tokenomic model’s success will be dependent on the creation of a Convex-like layer. Second, without such layer absorbing most emissions, there is a risk most rewards are sold very quickly if most farmers are not veYFI holders. This would negate the positive price pressure.

Our take is that unifying the YFI liquidity available across CEXs and DEXs on a few core pools, inspired by Balancer’s implementation of the gauge framework, where fees goes directly to LPs and veYFI holders could also increase the sustainability of the protocol in a rough DeFi environment.

Author’s dashboard : https://dune.com/queries/1824359

So far the veYFI and new framework for governance participation only attracted 4.8% of the total YFI supply. However, the fact that almost 55% of the YFI supply is still held in wallets unused neither in staking, liquidity providing or by any institutional entity means that a very large amount of capital is waiting to see success of the gauges & buybacks before locking in. The low number of veYFI at the time means current lockers will benefit from a few high earning rounds before others join the fray.

All in all, we are incredibly excited about the YFI wars, and so should you.