“Humans always try to distort equilibriums to get short-term benefits, whether it be with drugs and the body, or with borrowed money & our net worth. Eventually, life always reverts to the mean; it’s simply a rule of complex adaptive systems.”

This echoes the words of Curvecap substack on 01/19/2022 stating that “trading fees are quite a bit lower than the emissions. This is not really contentious. Everybody wants the boosted rewards [...]”.

We have witnessed DeFi's resilience after FTX's fallout. However, this week's hot topic was more of a trial by fire, both for Curve as an ecosystem and Aave as a protocol. Without further ado, let's talk about The Big Short (Squeeze).

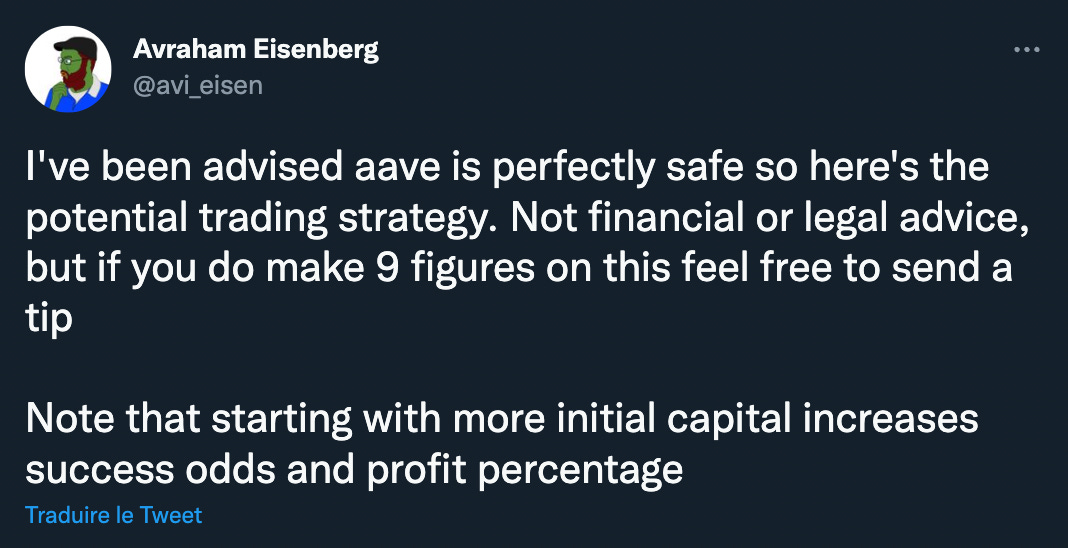

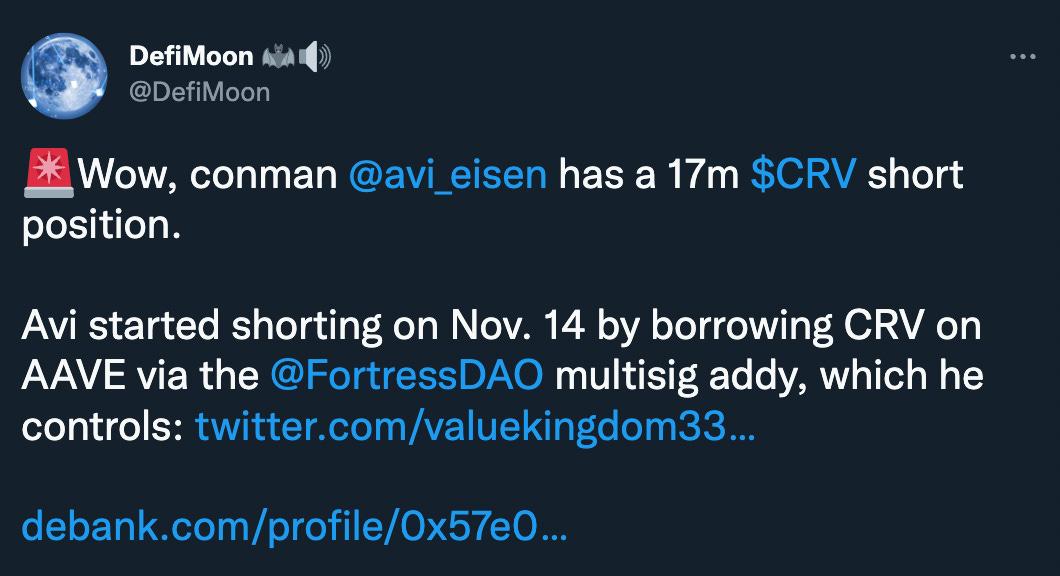

As he announced in October, the infamous Mango exploiter Avraham Eisenberg sought to reproduce his “highly profitable strategy” on AAVE lending market, and, this time, targeted the $CRV token to perform his manipulation. Starting on Nov.14 Avi borrowed a total of nearly 100M $CRV against $50M of USDC on @AaveAave.

His motivations are still unclear. We do not know if he aimed to trigger the liquidation of Curve’s founder @newmichwill (around 0.25$) and benefits from the $CRV collapse, or had an ulterior motive. However, we can affirm that he has sent at least 71M $CRV on OKEX and speculate on the fact that he sold it or used it to hedge his manipulation.

By a strange coincidence, the whitepaper and contracts of Curve's new stablecoin crvUSD were made public at the climax of the $CRV panic, triggering a sort of whiplash effect on the token's price, which resulted in a cascade of liquidations on Avi's position and propelling the token from $0.4 to $0.74 in a few hours.

Ironically, the main feature of this new stablecoin lending model proposes a continuous liquidation system that would have allowed AAVE to avoid such a situation. This statement is to be taken with a grain of salt since Aave V3 should also offer this kind of protection, although several technical issues remain regarding the transition from V2 to V3.

At the end of the day, the impact on AAVE is very limited. The bad debt represents around 0.5% of the safety module, the DAO has enough cash reserve to pay 20x the current debt, 1.6M$ is 60 days of revenue for the DAO at the current pace. This explains why the price of $AAVE quickly recovered.

We believe the most dangerous fallback, that very few mentioned, would have been a direct attack to Curve governance. Had the exploiter locked the 92M veCRV he would have controlled close to 15% of the gauge. At current prices, this would imply 300,000$ of weekly cash flow and a significant hold over the equilibrium of stablecoins.

This kind of situation is reminiscent of the Balancer case and the control of a malicious coalition on emissions, which has been shown to be very dangerous for the sustainability of the gauge framework.

Of course, this would have implied a way more time-consuming and long-term committed strategy, which he is not known for.