Weekly Gauge #12 : Real Yield pt.2 (Curve side)

The recent history of liquid lockers on Curve can already be split into two generations. At first, Convex created the cvxCRV and Yearn finance introduced the yveCRV. One common attribute to these wrappers, which also is the main difference between gen1 and 2 lockers, is the inability for the staker to keep usage of his voting power. The second generation of lockers such as StakeDAO sdCRV and soon the new Yearn locker yCRV, offers the ability for users to cast votes on gauges.

We’ll see how this major change in the token utility can impact the yield mechanism of liquid lockers:

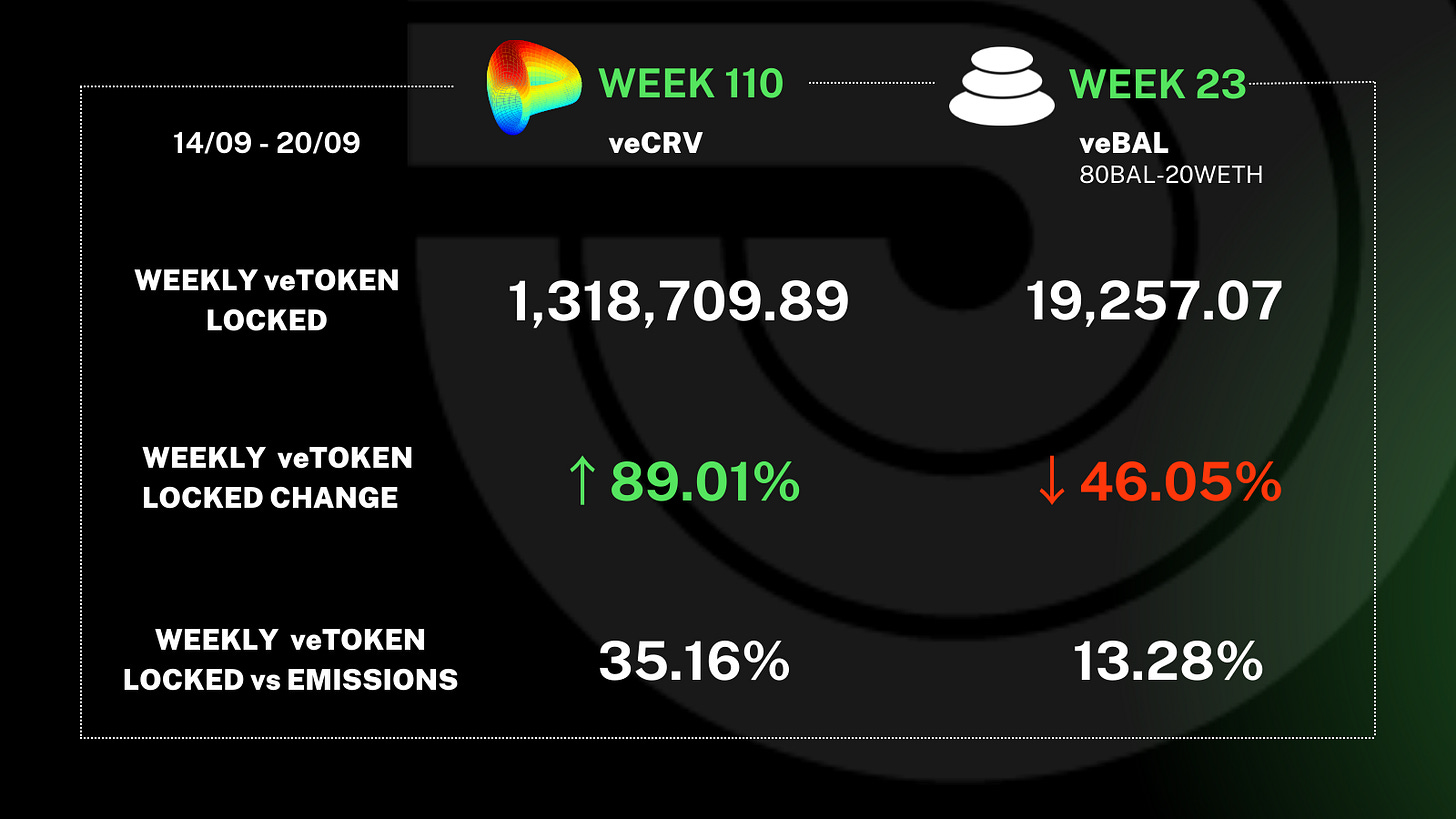

Curve week 110

Last week, we defined the real yield equation. In our formula, the total revenue generated, after operational costs, by a protocol should be superior to the total value of native tokens emitted during the same timeframe. Moreover, we stated that the fee structure of Convex and Aura wrappers was aligned to their bonding curve, establishing a symbiotic and value creative stack on top of Curve or Balancer.

VeCRV liquid lockers value creation: At the very beginning, Curve stakeholders earn revenues on fees generated by the platform as well as from CRV incentives for liquidity providers. Considering the latest data, the protocol prints $495,000 of CRV tokens daily for an average $69,500 of collected fees. This, seems pretty fair since the company is valuing itself less than 10x its revenue and that half of the CRV supply is locked.

The first generation of liquid lockers then entered the game with the original value proposition to add time sensitivity for users who don’t want to lock their CRV for such a long duration. This implies several prerequisite characteristics: the main one being basically to insure a stable peg on the wrapper to CRV trading pair.

On top of Curve’s redistributed revenues, the liquid locker will incentivize its usage by adding another layer of yield earned in their own native token. Being a decentralized organization allows you to redistribute the fees between stakeholders while accounting it as revenues for the company.

https://dune.com/paladin/gauge-weekly

The above example illustrates that Convex tax on revenues currently represents a weekly 680,000$ while the CVX emission averages $750,000. This leads us to a total of $600,000 of daily printed tokens (CVX + CRV) for a $79,000 cumulated fee. Still valuing both projects under 10x their real yield.

https://dune.com/queries/1292152

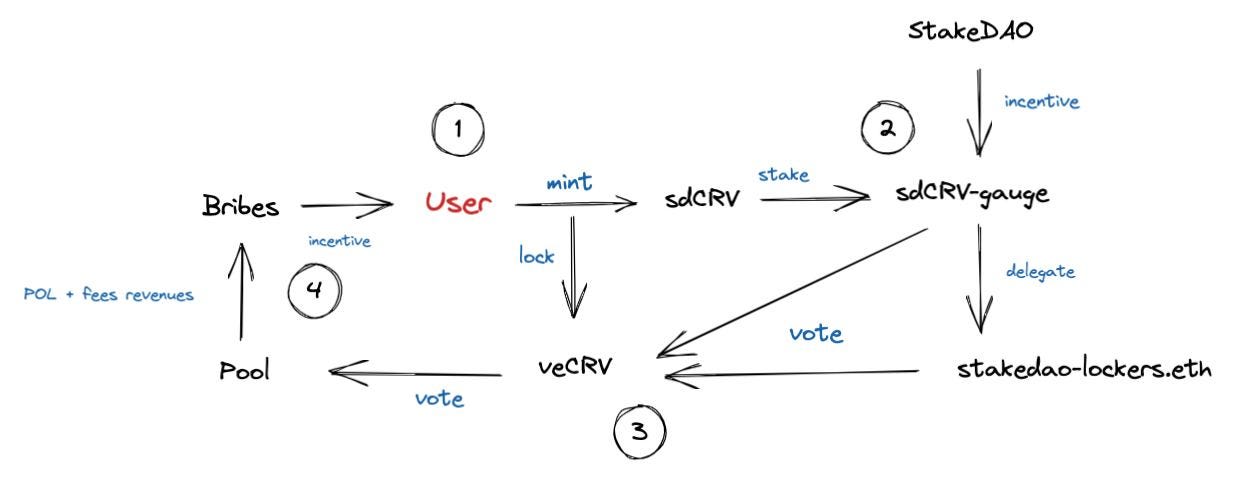

Because we will never stop elaborating new ways to maximize capital efficiency for users, the second generation of liquid lockers joined the race with a major change that drastically increase the potential yield - The ability for stakers to participate in the bribe market with the governance power of their locked (but still liquid) tokens. See an illustration of the sdCRV yield mechanism below.

StakeDAO liquid locker flywheel

Most revenues come from bribes : One obvious difference between first and second generations of wrappers is the composition of the staker revenues. On one hand cvxCRV owner directly earns veCRV revenues from Curve incentives, on the other hand sdCRV stakers are mostly rewarded with bribes incentives.

Paladin.vote became necessary to the sustainability of the ecosystem by offering to bribers the possibility to manage their incentive campaign according to their share of Curve revenues (acquired either through admin fees or protocol-owned liquidity). Quest’s fixed rate incentive system allows project to anticipate their operational costs in the real yield formula.

https://lockers.stakedao.org/

How bribe creator justifies incentives: The variety of tokens available as voting incentives have for primary effect to dilute the need in revenues of each bribe creator to match the real yield criteria of the underlying protocol Curve Finance.

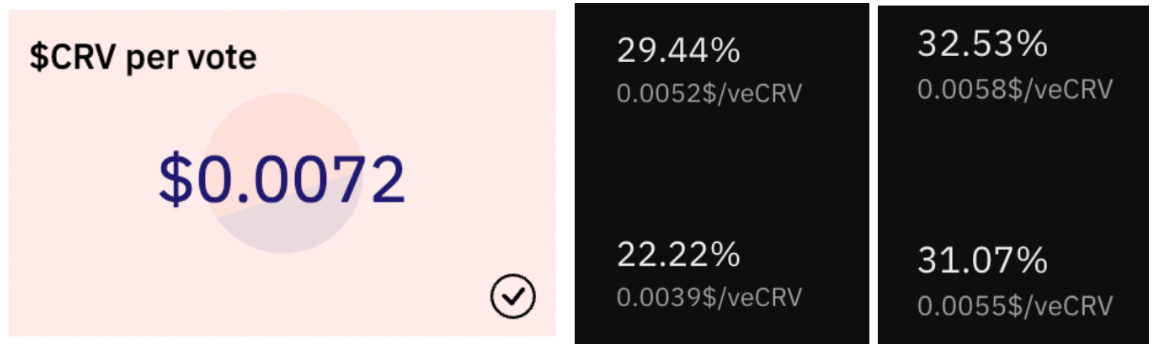

While this statement is theoretically true, we’ve already witnessed projects adopting an over-inflationary bonding curve to bootstrap their volume and TVL , making it empirically false. However, the latest data shows that the incentive per vote on the base Curve layer available on Gen 2 lockers matches the golden ratio, while 1st Gen lockers still offer inferior revenue to the bribers than their incentives value.

https://llama.airforce/#/bribes/rounds/votium/cvx-crv/27

Recently, Yearn Finance has announced their upcoming upgraded wrapper, called yCRV, meant to replace their first gen yveCRV and yvBoost suite of tools that struggle to make it back to the 1:1 CRV peg.

Yearn’s post on Curve governance forum says the following :

“yCRV is the latest generation of Yearn’s liquid veCRV wrapper product. It is an upgrade to the yveCRV/yvBOOST system that exists today, and will feature improved liquidity, yield, and the ability for users to cast votes on gauges.”

You can find a well-written and comprehensive explanation regarding yCRV in the latest crv.mktcap.eth article. “At the moment, details are scarce, but we have a few clues about what $yCRV will look like.”

This announcement comes with an interesting partnership starting with Abracadabra finance (MIM_Spell). A collaborative vault where Abra would get the voting power to direct emissions to $MIM-$3CRV pool while Yearn keeps the yield to sustain the $yCRV- $CRV liquidity.

Oh and last thing, after 12 editions of the Weekly Gauge I think I am confident enough to introduce myself, the usual author, as @Beguin__ on twitter :)

Haven’t gotten your full Curve fix yet? The Paladin team recently interviewed @CurveCap & @AmadeoBrands and took a deep dive into the Curve ecosystem. You can watch the full interview here: